Writer James Playsted Wooden as soon as wrote, “The factor that the majority impacts the inventory market is every little thing.”

The checklist does appear limitless whenever you begin ticking off the components that affect inventory market returns over time.

Headlines, geopolitical occasions, financial development, authorities insurance policies, human feelings, investor positioning, rates of interest, inflation, danger urge for food, demographics, quarterly earnings studies and the checklist might go on.

Within the 2010s most individuals assumed low rates of interest and quantitative easing have been propping up the inventory market. Within the early-2020s it was authorities spending. Proper now it looks like the AI increase is powering every little thing.

It’s at all times one thing.

However in the event you actually need to know what’s been driving the U.S. inventory market greater look no additional than earnings.

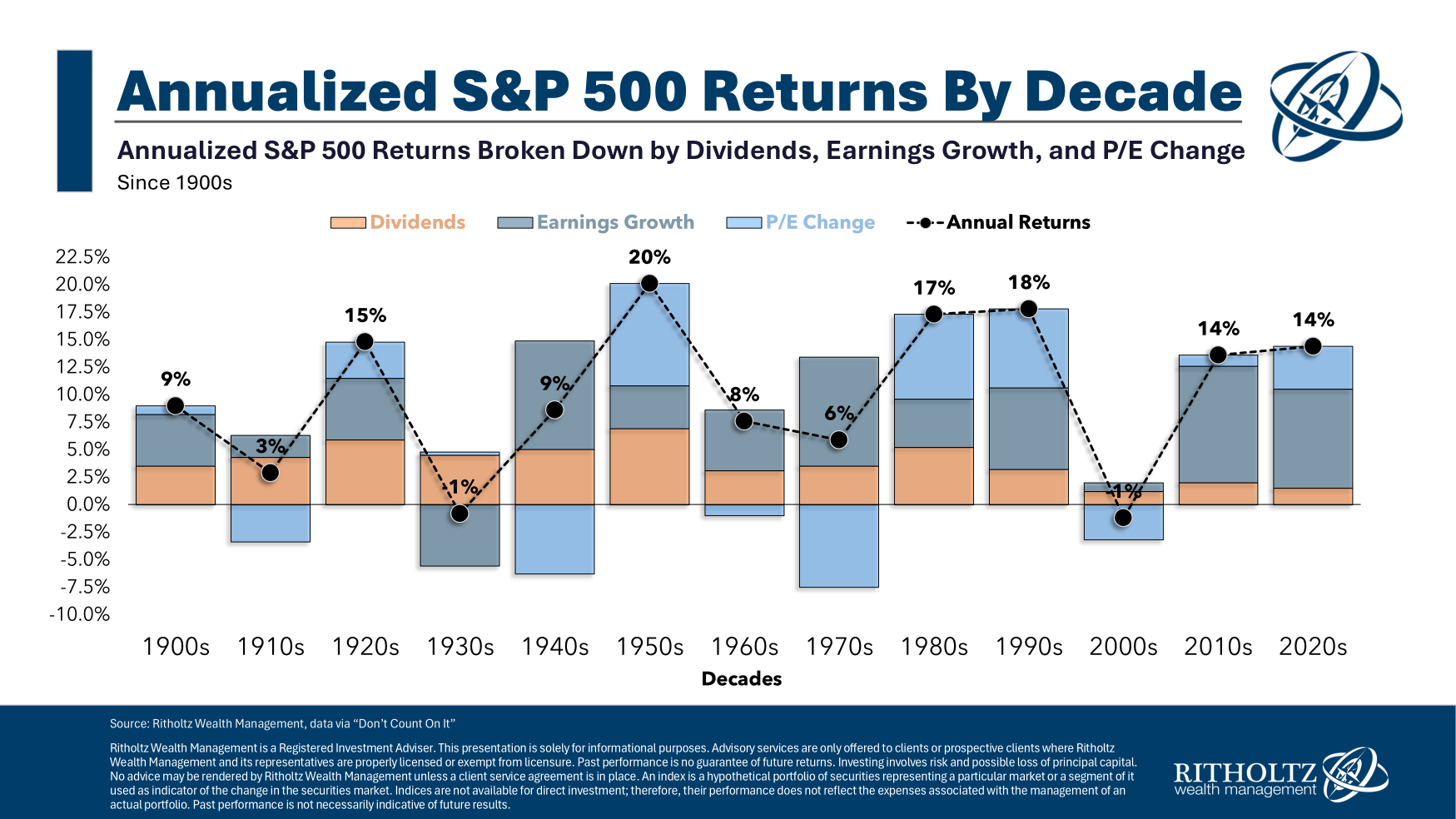

This turns into obvious whenever you take a look at the composition of inventory market returns by decade:

What’s driving the inventory market throughout this bull market?

Earnings!

Within the 2010s we had annual earnings development of practically 11%. Earnings have grown at simply shy of 10% per yr within the 2020s. That’s a lot greater than the long-term common of round 5% per yr.

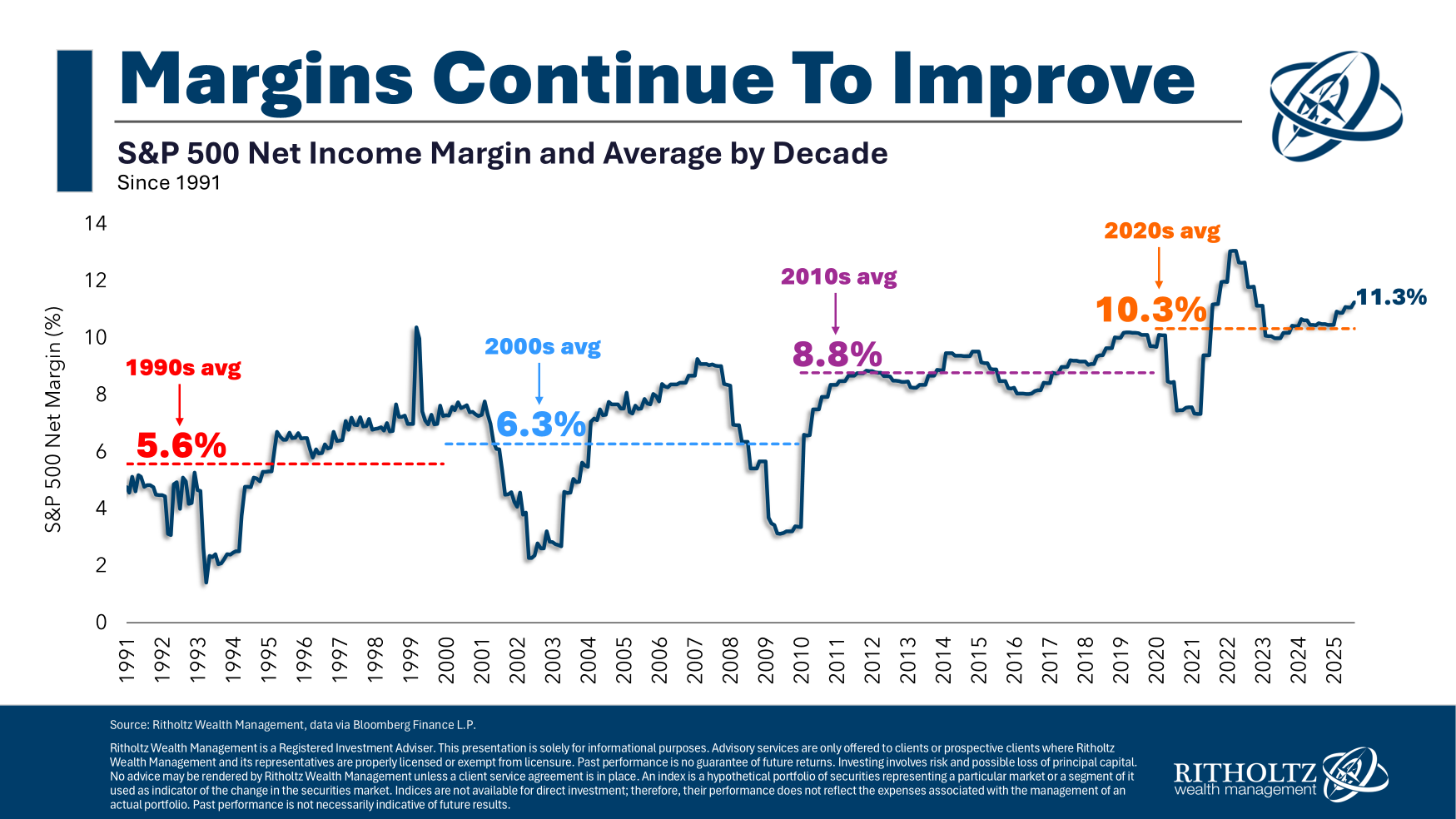

Shoppers and companies are spending cash. That cash is income for firms. After subtracting prices from these gross sales you get income. These income are greater now partly as a result of margins are greater:

It truly is that easy.

Earnings development doesn’t assure excessive inventory market returns. Earnings development was excessive through the Nineteen Forties (+9.9%) and Nineteen Seventies (+9.9%) however so was inflation and there have been extrernal components that triggered returns to be muted in these a long time.

Earnings development wasn’t all that sturdy within the Nineteen Twenties (+5.6%), Nineteen Fifties (+3.9%) or Eighties (+4.4%) however annual returns have been lights out in every of these a long time.

So these relationships aren’t written in stone.

Nonetheless, you may see that the misplaced a long time of the Nineteen Thirties and 2000s each had horrible earnings development of -5.6% and +0.8%, respectively.

If you wish to know why shares are up over the previous decade and a half, look no additional than earnings development.

It gained’t final eternally as a result of nothing does however this bull market has been carried by sturdy firm fundamentals.

Additional Studying:

Anticipated Returns within the Inventory Market

1It must also be famous that one of many causes dividend yields are decrease now than they have been up to now is as a result of buybacks (primarily the identical factor as dividends in a unique kind) are extra prevalent at this time. Share repurchases additionally enhance earnings per share by lowering the variety of shares on the open market.

This content material, which comprises security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will likely be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or provide to offer funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.