An Particular person Retirement Account (IRA) is a kind of funding account with tax benefits that helps you put together for retirement. Relying on the kind of IRA you spend money on, you can also make tax-free withdrawals if you retire, earn tax-free curiosity, or postpone paying taxes till retirement.

The earlier you begin investing in an IRA, the extra time it’s important to accrue curiosity earlier than you attain retirement age. However an IRA isn’t the one form of funding account for retirement planning. And there are a number of sorts of IRAs accessible. In case you’re planning for retirement, it’s essential to know your choices and discover ways to maximize your tax advantages.

In case your employer provides a 401(okay), it might be a greater possibility than investing in an IRA. Whereas anybody can open an IRA, employers usually match a portion of your contribution to a 401(okay) account, serving to your funding develop quicker.

On this article, we’ll stroll you thru:

- What makes an IRA completely different from a 401(okay)

- The sorts of IRAs

- How to decide on between a Roth IRA and a Conventional IRA

- Timing your IRA contributions

- IRA recharacterizations

- Roth IRA conversions

Let’s begin by what makes an Particular person Retirement Account completely different from a 401(okay).

How is an IRA completely different from a 401(okay)?

In the case of retirement planning, the 2 most typical funding accounts individuals speak about are IRAs and 401(okay)s. 401(okay)s provide related tax benefits to IRAs, however not everybody has this selection. Anybody can begin an IRA, however a 401(okay) is what’s often called an employer-sponsored retirement plan. It’s solely accessible by means of an employer.

Different variations between these two sorts of accounts are that:

- Employers usually match a proportion of your contributions to a 401(okay)

- 401(okay) contributions come proper out of your paycheck

- 401(okay) contribution limits are considerably greater

In case your employer matches contributions to a 401(okay), they’re mainly providing you with free cash you wouldn’t in any other case obtain. It’s usually sensible to reap the benefits of this match earlier than trying to an IRA.

With an Particular person Retirement Account, you establish precisely when and the right way to contribute. You’ll be able to put cash into an IRA at any time over the course of the yr, whereas a 401(okay) nearly all the time has to return out of your paycheck. Be aware that annual IRA contributions may be made up till that yr’s tax submitting deadline, whereas the contribution deadline for 401(okay)s is on the finish of every calendar yr. Studying the right way to time your IRA contributions can considerably improve your earnings over time.

Yearly, you’re solely allowed to place a hard and fast sum of money right into a retirement account, and the precise quantity usually adjustments year-to-year. For an IRA, the contribution restrict for 2025 is $7,000 should you’re below 50, or $8,000 should you’re 50 or older. For a 401(okay), the contribution restrict for 2025 is $23,500 should you’re below 50, or $31,000 should you’re 50 or older. These contribution limits are separate, so it’s not unusual for buyers to have each a 401(okay) and an IRA.

And as a aspect word for these 50 or older, beginning in 2026, 401(okay) catch-up contributions should go right into a Roth 401(okay) particularly should you obtained greater than $145,000 in FICA wages (salaries, commissions, and so on.) the prior yr.

What are the sorts of IRAs?

The problem for most individuals trying into IRAs is knowing which form of IRA is most advantageous for them. For a lot of, this boils right down to Roth and/or Conventional. The benefits of every can shift over time as tax legal guidelines and your revenue stage adjustments, so this can be a widespread periodic query for even superior buyers.

As a aspect word, there are different IRA choices fitted to the self-employed or small enterprise proprietor, such because the SEP IRA, however we received’t go into these right here.

As talked about within the part above, IRA contributions are usually not made straight out of your paycheck. That signifies that the cash you’re contributing to an IRA has already been taxed. Whenever you contribute to a Conventional IRA, your contribution could also be tax-deductible. Whether or not you’re eligible to take a full, partial, or any deduction in any respect is dependent upon should you or your partner is roofed by an employer retirement plan (i.e. a 401(okay)) and your revenue stage (extra on these limitations later).

As soon as funds are in your Conventional IRA, you’ll not pay any revenue taxes on funding earnings till you start to withdraw from the account. Because of this you profit from “tax-deferred” progress. In case you had been in a position to deduct your contributions, you’ll pay revenue tax on the contributions in addition to earnings on the time of withdrawal. If you weren’t eligible to take a deduction in your contributions, then you definitely usually will solely pay taxes on the earnings on the time of withdrawal. That is finished on a “pro-rata” foundation.

Comparatively, contributions to a Roth IRA are usually not tax deductible. When it comes time to withdraw out of your Roth IRA, your withdrawals will usually be tax free—even the curiosity you’ve collected.

How to decide on between a Roth IRA and a Conventional IRA

For most individuals, selecting an Particular person Retirement Account is a matter of deciding between a Roth IRA and a Conventional IRA. Neither possibility is inherently higher: it is dependent upon your revenue and your tax bracket now and in retirement.

Your revenue determines whether or not you may contribute to a Roth IRA, and likewise whether or not you’re eligible to deduct contributions made to a Conventional IRA. Nevertheless, the IRS doesn’t use your gross revenue; they have a look at your modified adjusted gross revenue, which may be completely different from taxable revenue. With Roth IRAs, your potential to contribute is phased out when your modified adjusted gross revenue (MAGI) reaches a sure stage.

In case you’re eligible for each sorts of IRAs, the selection usually comes right down to what tax bracket you’re in now, and what tax bracket you assume you’ll be in if you retire. In case you assume you’ll be in a decrease tax bracket if you retire, suspending taxes with a Conventional IRA will doubtless end in you protecting extra of your cash. In case you count on to be in the next tax bracket if you retire, utilizing a Roth IRA to pay taxes now could be the more sensible choice.

The very best kind of account for it’s possible you’ll change over time, however making a selection now doesn’t lock you into one possibility ceaselessly. In order you begin retirement planning, give attention to the place you are actually and the place you’d wish to be then. It’s wholesome to re-evaluate your place periodically, particularly if you undergo main monetary transitions reminiscent of getting a brand new job, dropping a job, receiving a promotion, or creating a further income stream.

Timing IRA contributions: why earlier is best

No matter which sort of IRA you choose, it helps to know how the timing of your contributions impacts your funding returns. It’s your option to both make a most contribution early within the yr, contribute over time, or wait till the deadline. By timing your contribution to be as early as attainable, you may maximize your time out there, which may assist you achieve extra returns over time.

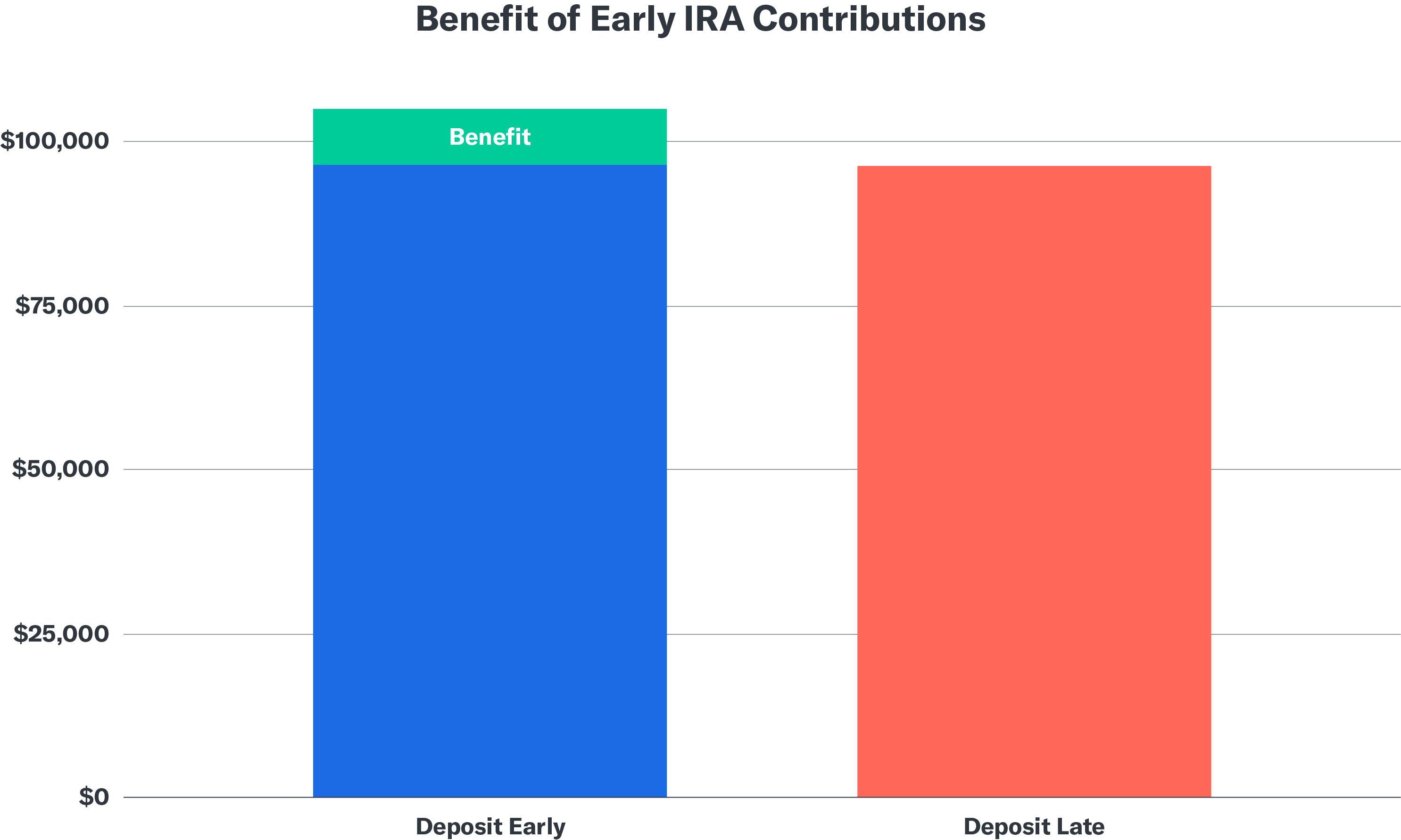

Think about the distinction between making a most contribution on January 1 and making it on December 1 every year. Then suppose, hypothetically, that your annual progress charge is 10%. Right here’s what the distinction may seem like between an IRA with early contributions and an IRA with late contributions:

This determine represents the eventualities talked about above.‘Deposit Early’ signifies depositing $6,000 on January 1 of every calendar yr, whereas ‘Deposit Late’ signifies depositing $6,000 on December 1 of the identical calendar yr, each yearly for a ten-year interval. Calculations assume a hypothetical progress charge of 10% yearly. The hypothetical progress charge is just not primarily based on, and shouldn’t be interpreted to replicate, any Betterment portfolio, or some other funding or portfolio, and is solely an arbitrary quantity. Additional, the outcomes are solely primarily based on the calculations talked about within the previous sentences. These figures don’t consider any dividend reinvestment, taxes, market adjustments, or any charges charged. The illustration doesn’t replicate the prospect for loss or achieve, and precise returns can range from these above.

This determine represents the eventualities talked about above.‘Deposit Early’ signifies depositing $6,000 on January 1 of every calendar yr, whereas ‘Deposit Late’ signifies depositing $6,000 on December 1 of the identical calendar yr, each yearly for a ten-year interval. Calculations assume a hypothetical progress charge of 10% yearly. The hypothetical progress charge is just not primarily based on, and shouldn’t be interpreted to replicate, any Betterment portfolio, or some other funding or portfolio, and is solely an arbitrary quantity. Additional, the outcomes are solely primarily based on the calculations talked about within the previous sentences. These figures don’t consider any dividend reinvestment, taxes, market adjustments, or any charges charged. The illustration doesn’t replicate the prospect for loss or achieve, and precise returns can range from these above.

What’s an IRA recharacterization?

You may contribute to an IRA earlier than you’ve gotten began submitting your taxes and should not know precisely what your Modified Adjusted Gross Earnings will likely be for that yr. Due to this fact, it’s possible you’ll not know whether or not you may be eligible to contribute to a Roth IRA, or if it is possible for you to to deduct your contributions to a Conventional IRA.

In some circumstances, the IRS lets you reclassify your IRA contributions. A recharacterization adjustments your contributions (plus the positive aspects or minus the losses attributed to them) from a Conventional IRA to a Roth IRA, or, from a Roth IRA to a Conventional IRA. It’s most typical to recharacterize a Roth IRA to a Conventional IRA.

Usually, there aren’t any taxes related to a recharacterization if the quantity you recharacterize contains positive aspects or excludes {dollars} misplaced.

Listed below are three cases the place a recharacterization could also be best for you:

- In case you made a Roth contribution throughout the yr however found later that your revenue was excessive sufficient to scale back the quantity you had been allowed to contribute—or prohibit you from contributing in any respect.

- In case you contributed to a Conventional IRA since you thought your revenue could be above the allowed limits for a Roth IRA contribution, however your revenue ended up decrease than you’d anticipated.

- In case you contributed to a Roth IRA, however whereas getting ready your tax return, you understand that you simply’d profit extra from the instant tax deduction a Conventional IRA contribution would probably present.

Moreover, we’ve got listed just a few strategies that can be utilized to right an over-contribution to an IRA on this FAQ useful resource.

You can not recharacterize an quantity that’s greater than your allowable most annual contribution. You may have till every year’s tax submitting deadline to recharacterize—until you file for an extension otherwise you file an amended tax return.

What’s a Roth conversion?

A Roth conversion is a one-way avenue. It’s a probably taxable occasion the place funds are transferred from a Conventional IRA to a Roth IRA. There is no such thing as a such factor as a Roth to Conventional conversion. It’s completely different from a recharacterization as a result of you aren’t altering the kind of IRA that you simply contributed to for that specific yr. There is no such thing as a cap on the quantity that’s eligible to be transformed, so the sky’s the restrict for people who select to transform. We go into Roth conversions in additional element in our Assist Middle.