The recession through the onset of the pandemic was the worst quarterly GDP decline because the Nice Despair. The unemployment fee shot up from lower than 4% to greater than 14% in a single month.

However this doesn’t rely as a real recession.

We shut off the financial system like a light-weight swap however then turned it again on. Plus the federal government despatched out trillions of {dollars} in help to households, companies and states. Unemployment insurance coverage was so beneficiant that many individuals had been making extra money by not working.

This is the reason the “recession” lasted simply two months.

So far as I’m involved the final actual recession we’ve had in America led to June of 2009.

Which means it’s been 196 months because the final true financial downturn within the U.S. or practically sixteen-and-a-half years!

Positive, sure industries have taken their lumps on this time1 and the expansion hasn’t all the time been strong however we maintain simply chugging alongside.

Quite a bit has modified because the Nice Monetary Disaster.

New asset courses have popped up. There are way more buyers in shares than ever earlier than. Households are far wealthier. Everybody expects to get bailed out if one thing goes mistaken. There’s a complete new subset of degenerate gamblers enjoying the market. It’s simpler than ever to tackle leverage and threat in new funding autos.

I’ve no capability to foretell when the following recession will occur however I’ve loads of questions on what is going to transpire when it does:

Will the wealth impact make issues worse? The highest 10% accounts for 50% of shopper spending. Excessive inventory costs have quite a bit to do with this.

Try this story from Redfin about arising with a down cost:

“With the housing market in a downturn, the people who find themselves shopping for are those that are financially snug, safe of their jobs, and have cash prepared and ready within the financial institution for a down cost,” stated Andrew Vallejo, a Redfin Premier agent in Austin, TX. “For instance, just a few months in the past I helped a purchaser shut on an $800,000 house with a 50% down cost. They had been capable of liquidate shares to make a $400,000 down cost with out excited about it an excessive amount of, and now their month-to-month funds are decrease.”

There are many households spending extra freely as a result of their portfolios are larger than anticipated as a result of hard-charging bull market.

I’m curious to see if it would take a recession to decelerate the highest 10%.

Will younger buyers keep invested? Younger buyers are all-in on the inventory market. Most have by no means skilled the results from an precise recession whereas within the working world.

It feels condescending as a middle-aged particular person to foretell that beginner buyers will hit the eject button throughout a recession.

However that occurs to a sure section of each new technology of buyers ultimately.

Millennials hated the inventory market following the 2008 disaster.

Will Gen Z buck the pattern?

We will see.

What’s going to occur to the brand new personal investments? There are trillions of {dollars} in personal credit score and much more in personal fairness. How will these funds react to an financial slowdown?

Extra importantly, how will buyers in these illiquid fund autos react?

Will buyers proceed to purchase the dip? Shopping for the dip is one of many largest investor developments of the 2020s.

Will that proceed as soon as the leveraged ETFs get taken out to the woodshed? As soon as the speculative shares get hammered? As soon as the market doesn’t have a V-shaped restoration?

You can persuade me both means on this one.

Will households ramp up their borrowing? Keep in mind when everybody made an enormous deal about bank card debt hitting $1 trillion?2

It by no means nervous me as a result of the American shopper’s capability for borrowing has grown much more than our debt ranges.

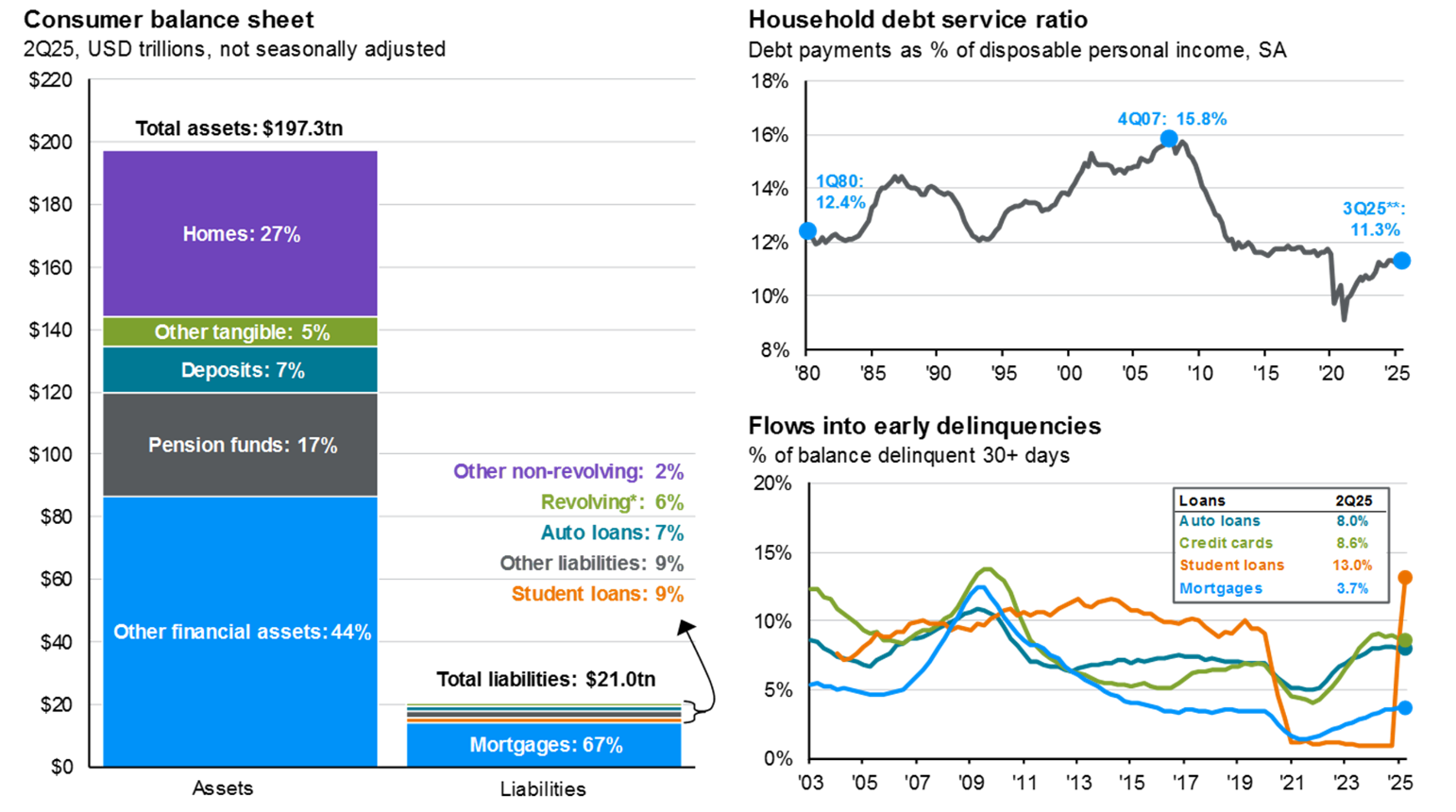

JP Morgan has some good charts that inform the story right here:

The property are far better than the liabilities. However take a look at the debt service ratio. Debt funds relative to disposable earnings are decrease now than they had been at anytime within the Eighties or Nineties.

Family stability sheets are nonetheless in fairly good condition.

In a pinch, customers have the power to lever up and borrow extra money if want be.

I’m curious to see if households would like to rein of their spending habits or borrow cash to maintain the get together going.

We’ll simply have to attend for the following recession, at any time when it comes, to reply all these questions.

I used to be in New York Metropolis this week and dropped in on The Compound and Buddies with Josh, Michael and Sonali Basak to speak about how a recession will impression personal credit score and far more:

Or take a look at the podcast model right here:

Additional Studying:

Can the Inventory Market Trigger a Recession?

1Housing the previous few years, tech in 2022, and many others.

2It’s as much as $1.2 trillion now.