For most individuals, tax season ends as soon as the return is filed. However the actual anxiousness begins when an surprising revenue tax discover lands within the mailbox. Even a small error—like forgetting to report curiosity revenue or a mismatch in Type 26AS—can draw the Earnings Tax Division’s consideration. Whereas the thought of coping with a discover could sound worrying, the reality is most of them are avoidable. All it takes is correct reporting, well timed submitting, and sensible monetary self-discipline. With the fitting method—and steerage from skilled tax consulting companies or a trusted tax guide—you possibly can keep compliant, reduce threat, and luxuriate in a worry-free tax journey. On this weblog, we’ll break down why individuals obtain revenue tax notices, the frequent errors to keep away from, and the way a trusted tax guide will help you keep compliant whereas saving extra within the course of.

Why Do Folks Obtain Earnings Tax Notices?

Earlier than studying easy methods to keep away from them, it’s vital to grasp why revenue tax notices are despatched. Widespread causes embrace:

- Mismatch in Earnings Reporting – When the revenue you report doesn’t match knowledge accessible with the IT division (e.g., Type 26AS, AIS, or TIS).

- Non-Submitting of Returns – Should you’re required to file however fail to take action.

- Extreme Deductions or Claims – Claiming deductions you aren’t eligible for or with out proof.

- Excessive-Worth Transactions – Massive property purchases, investments, or financial institution deposits not defined in ITR.

- Unreported International Belongings or Earnings – Failing to reveal abroad investments or accounts.

- Money Transactions Above Limits – Heavy money deposits/withdrawals that elevate suspicion.

- Scrutiny Primarily based on Danger Parameters – Random scrutiny or pattern-based detection by IT algorithms.

The tax division is turning into more and more data-driven. With techniques like AIS (Annual Data Assertion) and data-matching instruments, even small inconsistencies can elevate crimson flags.

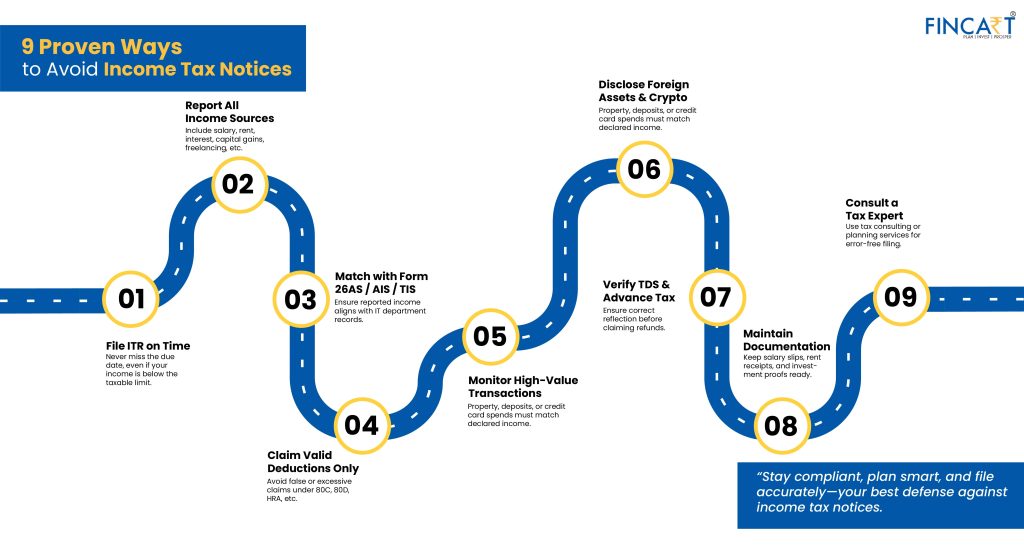

Confirmed Methods to Keep away from Earnings Tax Notices

Listed here are actionable methods that can assist you keep away from getting revenue tax notices and keep peace of thoughts:

1. File Your Earnings Tax Return on Time

Late or missed submitting is without doubt one of the commonest causes for notices. Make sure you file earlier than the due date, even when your revenue is beneath the taxable restrict (in case you’ve had high-value transactions, submitting continues to be really useful).

Professional Tip: Set a reminder in June or July, so that you don’t wait until the final day in September/October.

2. Report All Sources of Earnings

Many taxpayers overlook to incorporate:

- Freelance/aspect enterprise revenue

- Rental revenue

- Curiosity from financial savings accounts, FDs, or bonds

- Capital good points from shares, mutual funds, or crypto

Failing to report such revenue can lead to notices. Guarantee your ITR displays each revenue supply.

3. Match Your Earnings with Type 26AS, AIS, and TIS

The Earnings Tax Division collects particulars from banks, employers, mutual funds, and different establishments. All the time cross-check your revenue with:

- Type 26AS (tax deducted at supply)

- AIS (Annual Data Assertion)

- TIS (Taxpayer Data Abstract)

Mismatch = potential discover.

4. Keep away from Extreme or Incorrect Deductions

Taxpayers usually make errors whereas claiming deductions beneath Sections 80C, 80D, 24(b), and many others.

- Don’t declare with out proof (e.g., insurance coverage premiums, tuition charges, ELSS investments).

- Keep away from over-reporting HRA or dwelling mortgage curiosity deductions.

An excellent tax guide ensures deductions are claimed accurately, serving to you maximize financial savings with out triggering suspicion.

5. Hold an Eye on Excessive-Worth Transactions

The IT division displays:

- Money deposits above ₹10 lakh in financial savings accounts

- Property purchases above ₹30 lakh

- Bank card spends above ₹10 lakh yearly

- Massive investments in mutual funds, shares, or bonds

If these don’t align along with your declared revenue, you could get a discover.

6. Disclose International Belongings and Crypto Holdings

With tighter world tax laws, unreported international financial institution accounts, property, or cryptocurrency investments can result in strict notices and penalties.

7. Confirm TDS and Advance Tax Funds

If TDS (Tax Deducted at Supply) or advance tax has been deducted/paid, guarantee it’s mirrored in your Type 26AS. Claiming a refund with out matching TDS particulars is a crimson flag.

8. Keep Correct Documentation

All the time maintain:

- Wage slips

- Hire receipts

- Funding proofs

- Financial institution statements

- Mortgage compensation particulars

In case of scrutiny, these paperwork are your finest protection.

9. Use Dependable Tax Submitting Platforms or Consultants

DIY submitting is sweet—however it’s liable to errors. By utilizing skilled tax planning companies or consulting an skilled tax guide, you possibly can keep away from errors, declare correct deductions, and keep compliant.

How Tax Consulting Providers Assist You Keep Discover-Free

Even if you’re diligent, the Indian tax system may be advanced. That is the place skilled tax consulting companies make all of the distinction.

Advantages of Hiring a Tax Guide:

- Error-Free Submitting: Ensures accuracy and prevents mismatches.

- Optimized Tax Planning: Helps you save tax legally by way of sensible structuring.

- Up to date Data: Tax consultants keep up to date with the most recent modifications.

- Illustration in Case of Notices: Should you nonetheless obtain a discover, a tax guide handles responses and illustration.

For each salaried people and enterprise homeowners, investing in skilled steerage means fewer possibilities of notices and higher peace of thoughts.

What to Do If You Obtain an Earnings Tax Discover?

Even after precautions, generally notices arrive as a consequence of system errors or minor mismatches. Right here’s easy methods to deal with them:

- Don’t Panic – Not all notices imply penalties. Some are simply data requests.

- Learn Rigorously – Perceive the kind of discover (u/s 139(9), 143(1), 143(2), and many others.).

- Cross-Examine with Your Information – Confirm paperwork and statements.

- Reply Inside the Deadline – All the time reply inside the stipulated time to keep away from escalation.

- Search Skilled Assist – Seek the advice of a tax guide for drafting the fitting response.

Sensible Tax Planning = Fewer Notices

The easiest way to remain worry-free is thru proactive tax planning companies. As a substitute of last-minute scrambling, plan your taxes initially of the monetary yr. This consists of:

- Investing in eligible tax-saving devices

- Managing advance tax funds quarterly

- Structuring wage parts well

- Preserving funding and expense proofs prepared

If you plan your taxes strategically, your returns are cleaner, deductions are legitimate, and notices change into uncommon.

Ultimate Ideas

Getting revenue tax notices may be intimidating, however most of them are preventable with well timed submitting, correct reporting, and correct documentation. With the assistance {of professional} tax consulting companies and steerage from an skilled tax planner, you cannot solely keep away from notices but in addition guarantee sensible tax financial savings yr after yr.

Bear in mind, tax compliance isn’t just about avoiding penalties—it’s about monetary self-discipline, transparency, and long-term peace of thoughts.

So, keep knowledgeable, plan forward, and file responsibly. That’s the surest solution to maintain tax notices away!