A reader asks:

I’m a 22-year-old CFA Degree 3 candidate. I work as a portfolio analyst for a wealth administration crew in a multinational financial institution. I’ve been working right here for a couple of yr, and haven’t discovered an excessive amount of pleasure. My crew consists of excellent folks, and I’m grateful that I’ve a job, however I spend most of my days plugging in Excel formulation. As well as, I’ve at all times seen myself as an introvert and battle to speak in giant, crowded areas. So, I don’t assume turning into a wealth advisor would swimsuit my present talent set. Potential concepts: Danger administration, working a fund, or non-public fairness in a blue-collar centered sector? Query: Do you’ve got any concepts on what I ought to do with my life?

My internet value is about $250-300k. I began a garden mowing enterprise in highschool and began investing after I was 17 and nonetheless mow lawns part-time. My mother and father lately bought divorced, so I’ve been scuffling with despair, and I’m unsure what a part of the nation my household will stay within the close to future. Since I’ve been working since 15 y/o and all via school, would you suggest that I take a protracted break (1-2 months) from work after I move CFA L3 to clear my head and take into consideration subsequent steps?

It is a lot to course of for a 22-year-old previous.

You’ve been carrying a whole lot of duty from a really younger age and now you’re coping with a tough household state of affairs. So my first piece of recommendation is to provide your self a break. Having a six-figure internet value at your age is an unimaginable accomplishment.

You’re already a future millionaire.

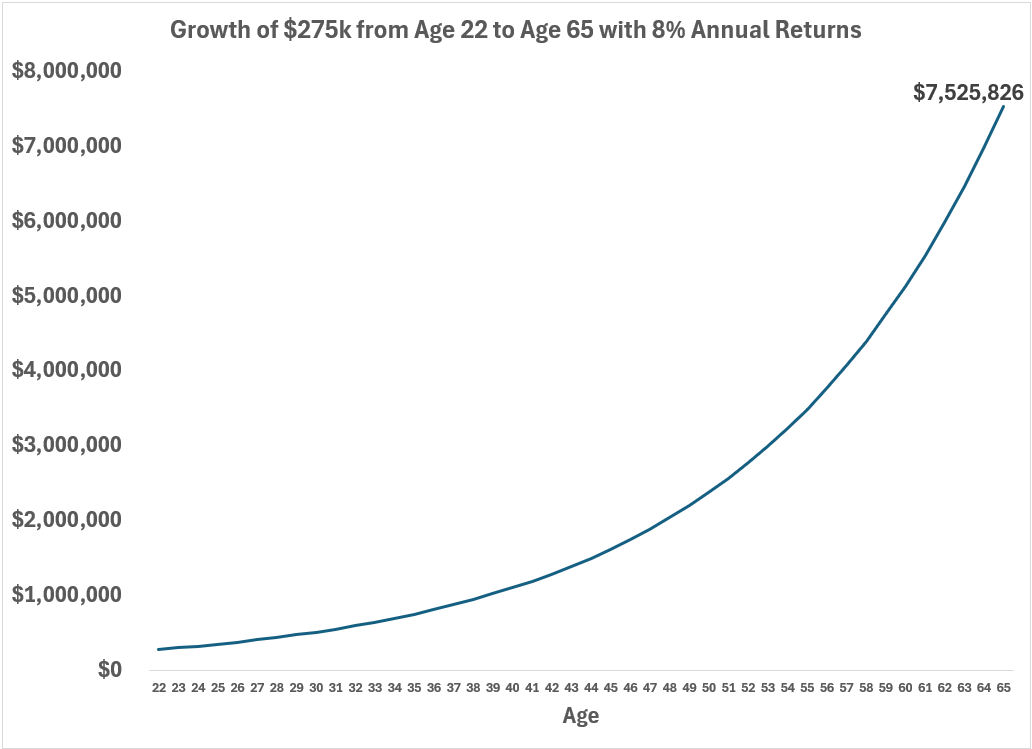

Let’s assume a internet value of $275k. In case you don’t add one other penny to that pile of money and develop it at 8% per yr till age 65, you’ll be value greater than $7.5 million:

That’s the great thing about compound capital from a younger age. If the financial savings are front-loaded, the compounding will probably be back-loaded.

So if you have to take a few months off to get your head proper, you’re ready to try this. Take a break if it’s going to assist your psychological well being. That’s what the cash is for. A few months out of labor in your 20s isn’t going to be the top of the world.

Providing profession recommendation is at all times tough however listed here are some concepts:

Given your introverted nature a job in threat administration would make sense. These are quant-heavy jobs so that you want a background in math and programming.

You could possibly go for an analyst function at a fund firm however these kinds of entry-level analyst positions are sort of a dying breed in the mean time. That is likely to be tough to interrupt into though getting your CFA ought to assist some.

You could possibly additionally contemplate going to work within the institutional house for a basis, endowment, pension or household workplace. That’s the place I bought my begin and it was a beautiful solution to study portfolio administration and the completely different fund buildings and funding methods.

The excellent news is you’re younger and may check the waters. There are a whole lot of completely different routes you would take within the finance world.

From one introvert to a different, I’ll give you another piece of profession recommendation — you need to discover ways to promote and talk successfully.

After I was youthful I used to look down on gross sales. I at all times had this image of used automobile salesman utilizing shady ways to trick you into shopping for one thing you don’t want.

I interviewed at a financial institution out of faculty for an analyst function they usually advised me the title of the function was analyst nevertheless it was principally a gross sales place. No you don’t get it, I’m an analyst! I don’t promote stuff!

However I rapidly discovered that everyone seems to be in gross sales whether or not you prefer it or not.

The key sauce of the funding enterprise appears one thing like this:

- You want analytical chops.

- You have to perceive behavioral psychology and human conduct.

- You want to have the ability to talk and promote your concepts successfully.

Warren Buffett himself as soon as stated, “Crucial talent in finance is salesmanship.”

In some ways, gross sales and advertising and marketing actually are all the things.

Discovering an excellent job is about promoting your self and your strengths. Discovering a partner is about advertising and marketing your good qualities. To place ahead the ideas and concepts that you just care about you’ve got to have the ability to persuade different those that your opinions matter. That is very true whenever you’re first developing within the working world and are brief on expertise.

Networking performs an enormous function for a lot of when discovering a job today so you need to have the flexibility to persuade others that they need to make a sale in your behalf.

Let’s say you determined to run your personal fund sometime. Do you assume it’s all about analyzing firms and choosing shares?

It’s a must to promote your technique to buyers too. Why do you assume all of those fund managers are on CNBC on a regular basis! Each prediction, inventory decide and macro forecast is a gross sales tactic to herald new buyers or maintain present buyers glad.

And if you happen to’re an analyst at certainly one of these funds you higher have the ability to promote your funding concepts to the remainder of the crew.

The factor that actually clicked for me is as soon as I discovered one thing I used to be enthusiastic about it didn’t really feel like gross sales anymore. I really like writing and speaking concerning the markets, asset allocation and investor conduct.

You simply should discover a firm, group of individuals or agency that matches your values and perception system. It doesn’t really feel like gross sales if you happen to imagine within the message.

Plus, you have already got the flexibility to speak and promote. You in some way discovered purchasers in your landscaping enterprise.

Within the short-term, give your self a break if it’s going to place you in a greater place mentally.

Within the long-term, you have to develop into extra comfy speaking with giant teams of individuals.

It’s a part of the job.

I lined this query on an all-new episode of Ask the Compound:

We additionally mentioned questions on Fed price cuts and your portfolio, Social Safety, the place to stash actual property income and the best way to set long-run return expectations.

Additional Studying:

The Secret Sauce of the Funding Enterprise