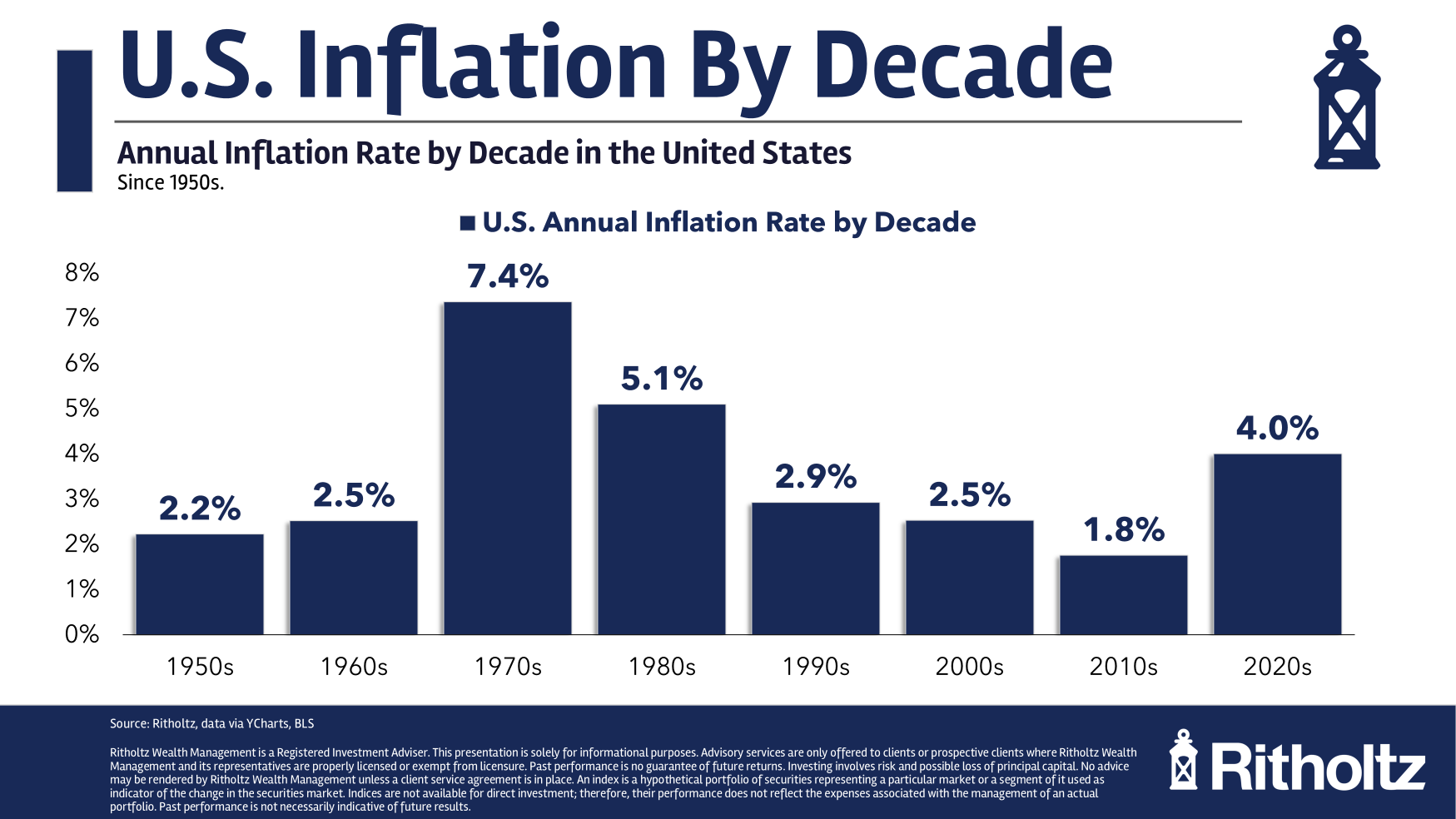

I shared this chart of inflation by decade this previous week:

I received a follow-up query in my inbox about this one from a reader:

What’s the funding implication of your inflation chart? Ought to I personal roughly shares when inflation is increased?

Good query.

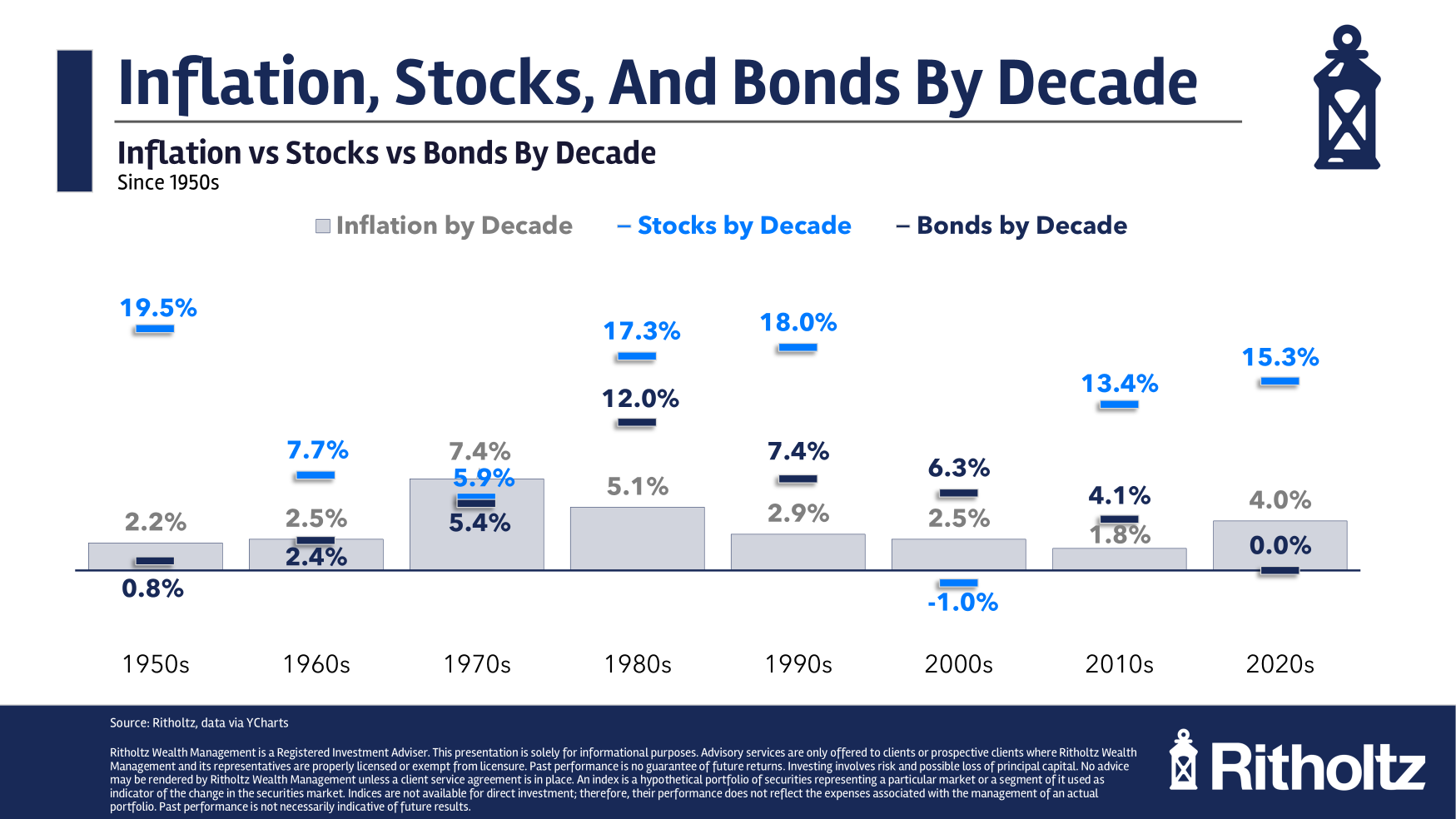

Right here’s a follow-up chart with annual inventory and bond returns with the corresponding inflation charges:

Increased than common inflation has not harm the inventory market within the 2020s.

Positive, there was the 2022 bear market however that is the best inflation price for the reason that Nineteen Eighties and the inventory market is compounding at 15% per 12 months.

The inventory market did simply wonderful with comparatively excessive inflation within the Nineteen Eighties too.

Inflation averaged 5% that decade however the inventory market did greater than 17% yearly.

The Seventies is the nightmare situation the place the sky-high inflation will get you. Actual returns had been destructive for the last decade.

The distinction is that inflation was rising all through the Seventies and falling from these excessive ranges within the Nineteen Eighties.

Bonds did equally properly within the Nineteen Eighties however lagged within the Seventies similar to the inventory market.

However bonds have taken it on the chin within the 2020s.

Inflation is the most important threat for presidency bonds over time however returns for fastened earnings are additionally impacted by beginning yields and the route of rates of interest.

There’s no easy components right here.

Should you’re a glass-is-half-empty individual you’ll take a look at my chart and level to the truth that two of the previous eight many years have seen shares fall behind the inflation price for an actual misplaced decade.

That’s painful.

The glass-is-half-full model is that the inventory market has compounded at 11.7% per 12 months since 1950. Take away the three.5% common inflation price in that point and it provides you an actual return of 8.2% per 12 months.

Greater than 8% higher than the inflation price seems like a fairly darn good long-term hedge to me.

I don’t know if that may repeat over the subsequent 75 years however the inventory market stays your finest hedge in opposition to inflation within the long-run even when that’s not at all times the case within the short-run.

Additional Studying:

Inflation is Not Going Again

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will likely be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.