Worldwide shares have underperformed for thus lengthy it is sensible many buyers assumed the turnaround final yr was a blip.

Perhaps it will likely be within the grand scheme of issues however the ex-U.S. commerce is gaining steam.

Let’s run via some charts.

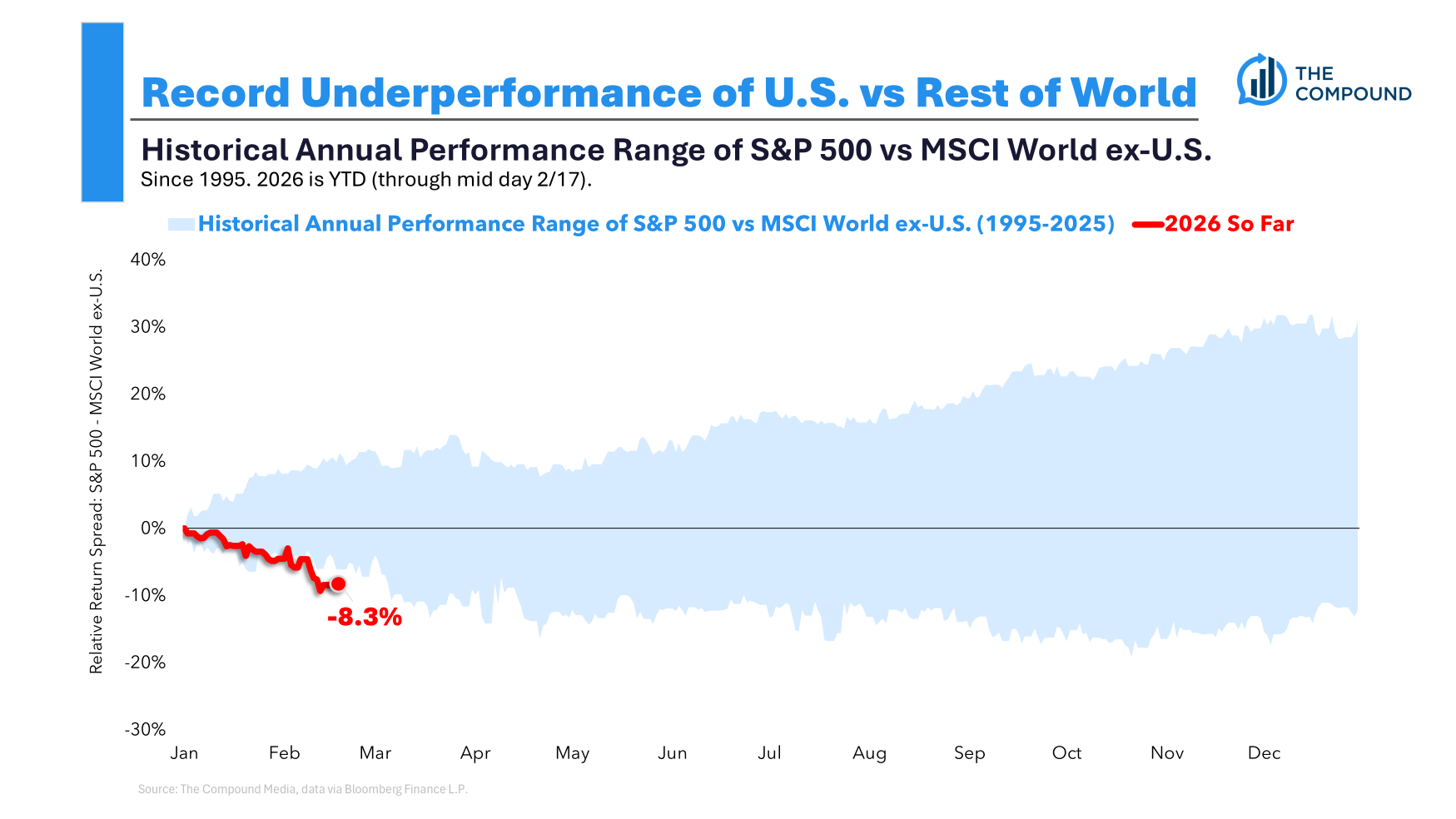

That is the perfect begin to the yr since 1995 by way of overseas outperformance over U.S. shares:

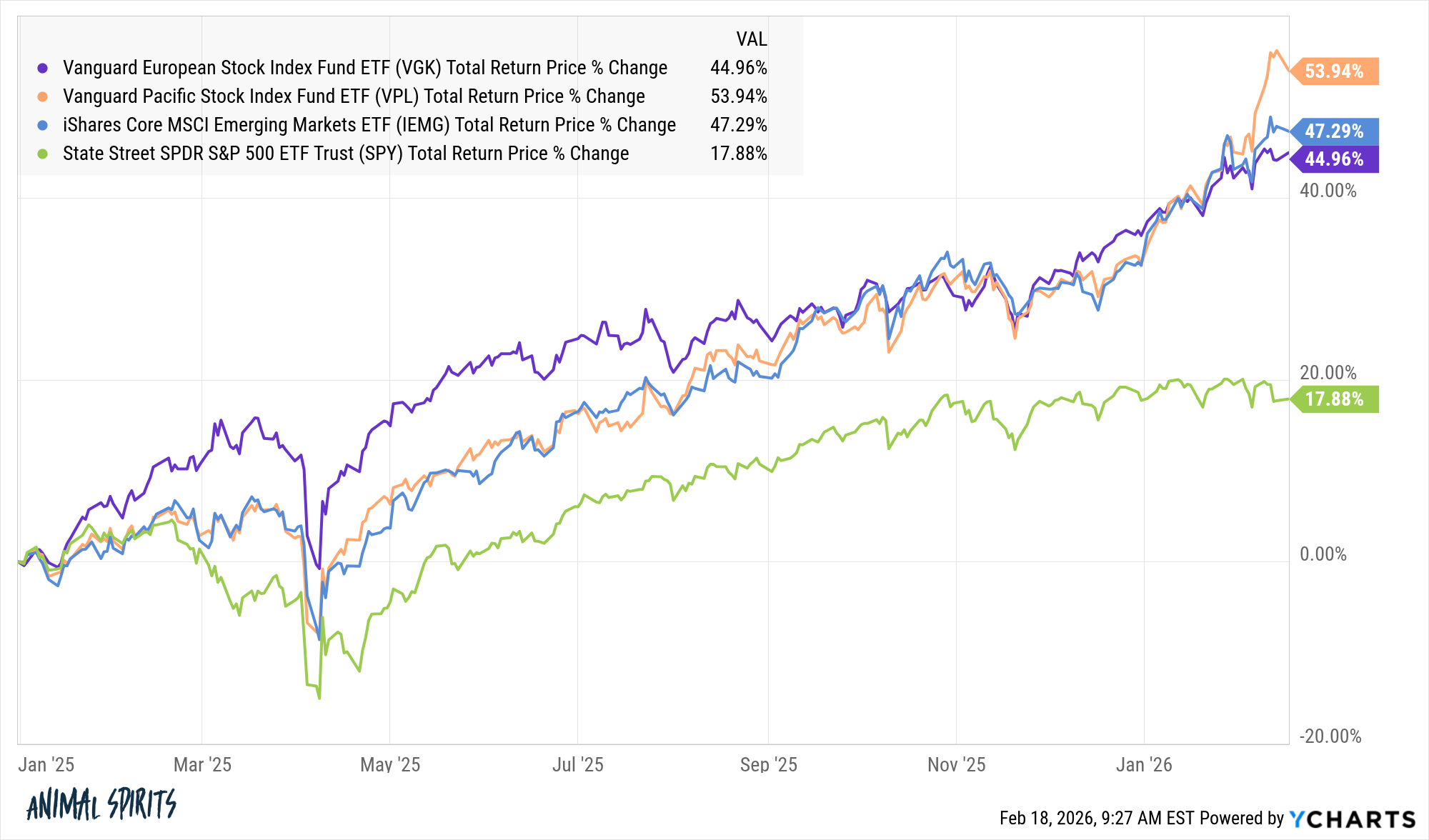

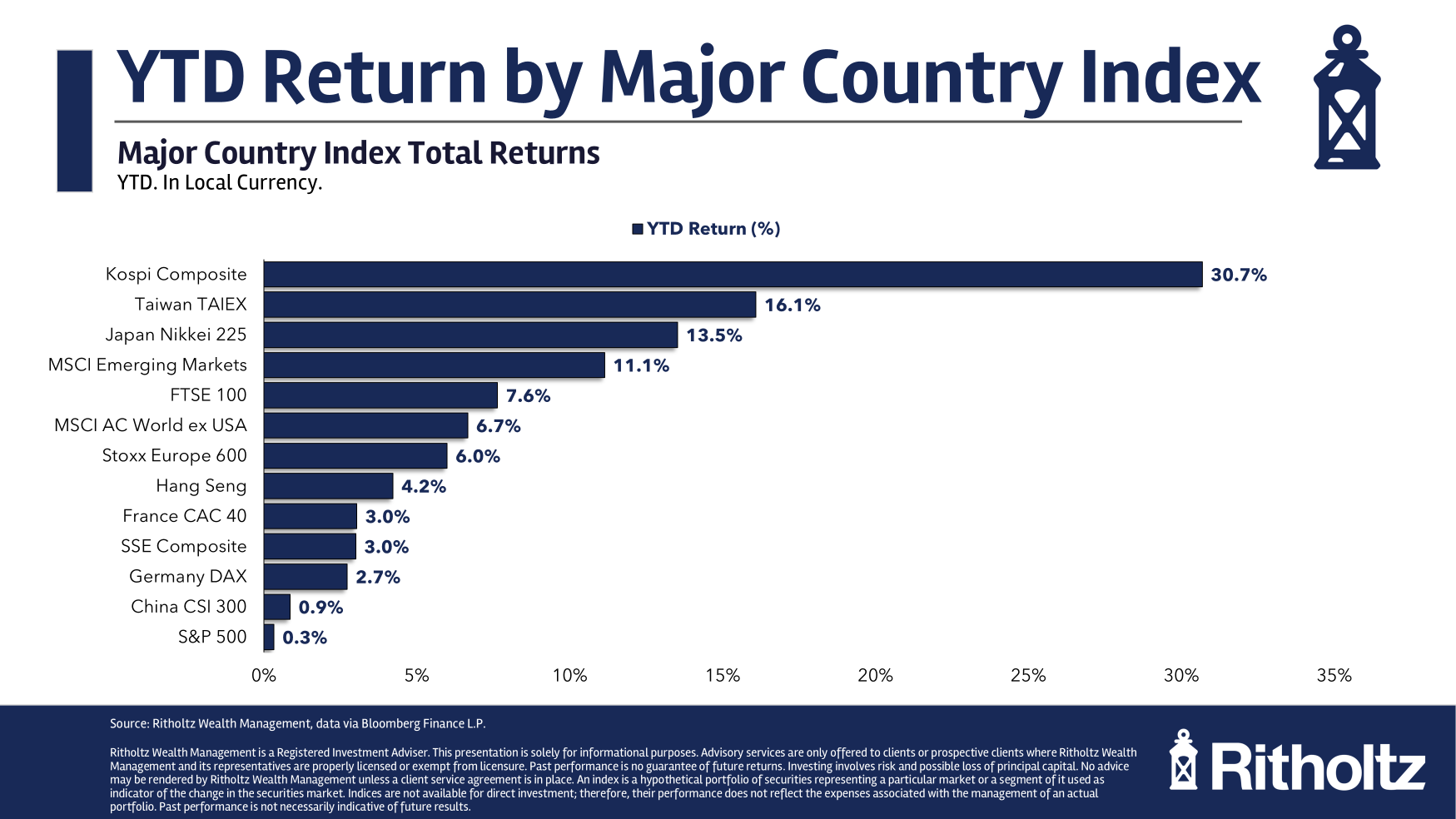

In case you look again to the beginning of 2025, the outperformance by European shares, Asian shares and rising markets is now fairly massive:

This is a bit more than a yr’s value of efficiency so it’s comprehensible many buyers don’t belief this rally. The U.S. inventory market has been the one recreation on the town for a few years now.

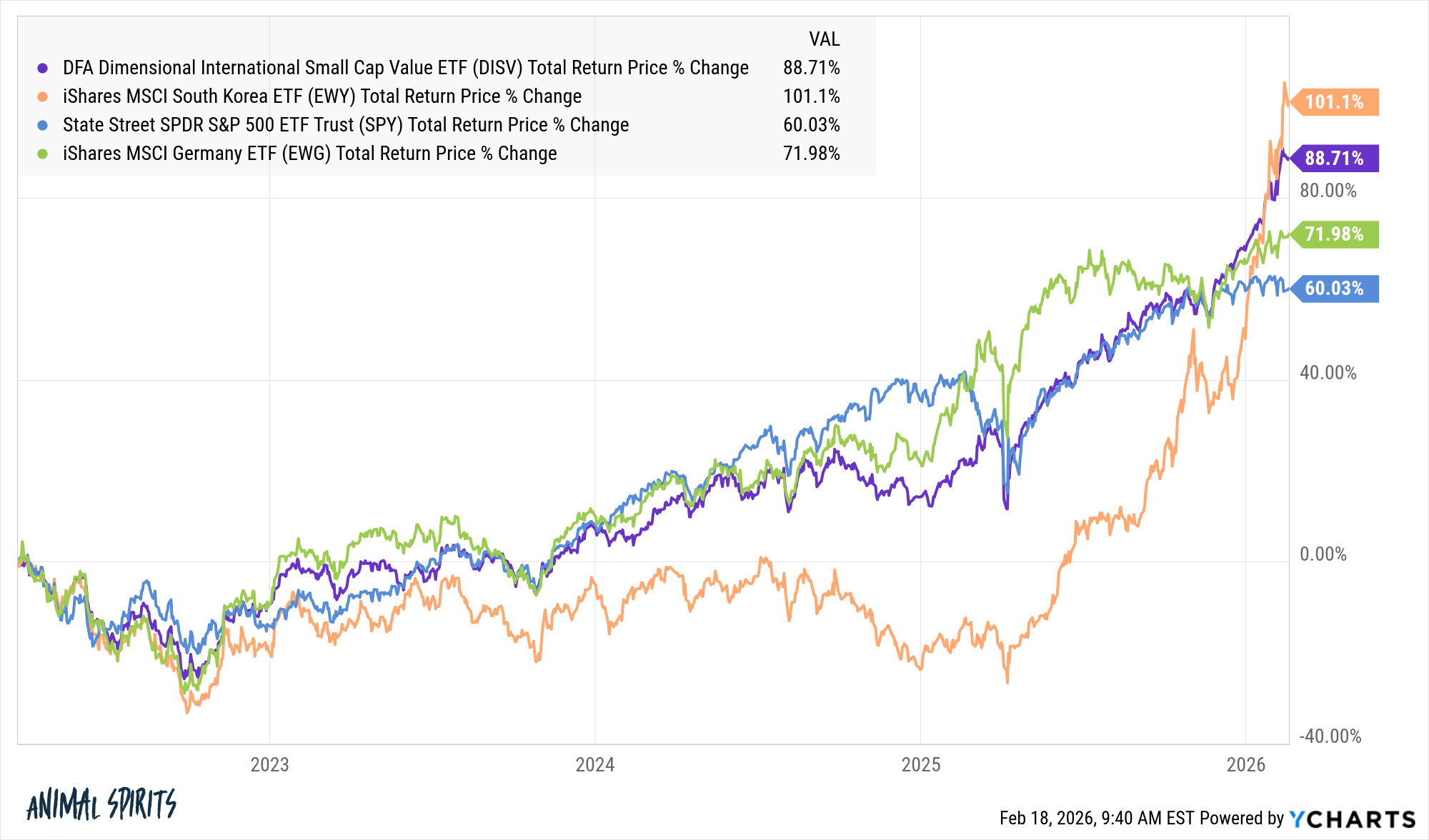

However take a look at the returns for Germany, South Korea and worldwide small cap worth shares over the previous 5 years:

All are outperforming the S&P 500 over a 5 yr interval.

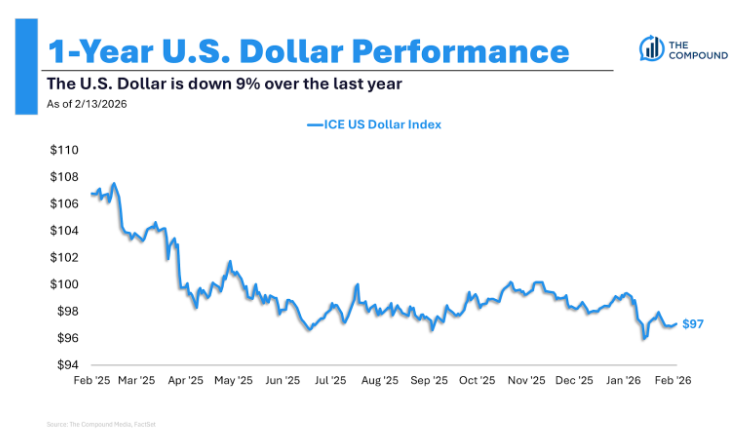

One of many huge causes for the outperformance is the falling greenback.

That’s a tailwind for U.S.-based buyers in overseas shares.

However this isn’t only a foreign money play. Even within the dwelling currencies, these inventory markets are outperforming the S&P 500 this yr:

I don’t understand how lengthy it will final. Tech shares have been so dominant within the U.S. for thus lengthy that some skepticism is warranted.

Nevertheless, it’s attainable this new cycle has legs.

U.S. officers appear to desire a decrease greenback via their insurance policies. The commerce battle has modified the best way buyers and companies view the US. If de-globalization actually is going on, different nations start loosening their fiscal purse strings, they usually maintain including shareholder-friendly insurance policies, worldwide shares might maintain successful on a relative foundation in a brand new cycle.

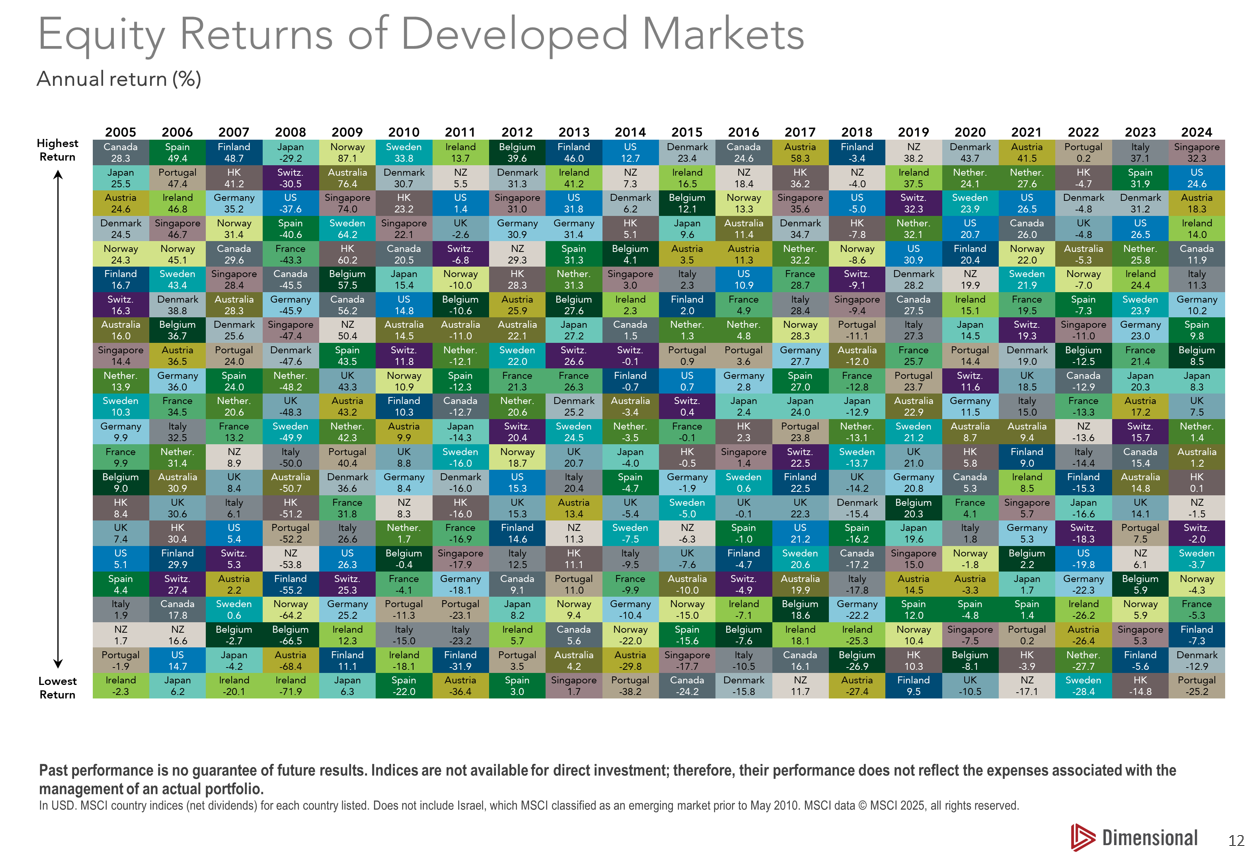

As a diversified investor, I don’t attempt to decide the winners upfront. That’s true for asset lessons and nations. Dimensional Fund Advisors has an incredible chart that ranks developed market nation inventory efficiency by yr:

Identical to asset lessons, there isn’t a rhyme or purpose from one yr to the following by way of the perfect and worst performers.

Lots of buyers have given up on worldwide diversification in recent times, and I don’t essentially blame them.

I nonetheless suppose it provides worth particularly in an ever-changing world.

I crammed in for Michael on What Are Your Ideas this week with Josh the place we talked worldwide shares, the good rotation, AI, software program shares, taxing the wealthy and extra:

Podcast model right here:

Additional Studying:

Is Diversification Lastly Working Once more?

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.