Working within the wealth administration enterprise has modified the way in which I view and work together with so many different elements of my life.

I’m continuously enthusiastic about on a regular basis interactions by way of the assemble of the inventory market and economic system. How does this enterprise generate profits? What does it imply for shopper spending that the airport is so busy at this time? I ponder how a lot that household that spends a lot cash has of their retirement and 529 accounts?

I’m continuously studying. Working within the markets requires you to concentrate to what’s occurring. You don’t need to act on all of it, however there may be numerous studying, writing and pondering concerned. Exterior of labor I do numerous studying, writing and pondering too. Proper or improper, it’s arduous to show it off typically.

I’ve bought higher filters now. Folks on the planet of finance are continuously providing opinions, evaluation and forecasts. Once you’ve been doing this lengthy sufficient you understand how improper individuals are on a regular basis, even the tremendous clever ones (or particularly them).

Working in finance has given me a a lot better BS detector to filter out the noise in different areas of life.

Finance has taught me to maintain my feelings at bay. It’s been crushed into my cranium time and again the significance of maintaining my emotions out of my funds. That’s not all the time straightforward however I’ve spent years determining the right way to automate my lesser self out of my monetary choices.

Don’t get me improper, I’m nonetheless human. I overreact, get mad, really feel grasping, scared, anxious, nervous, and all the different feelings.

However typically my spouse wonders why I don’t present extra enthusiasm. I don’t get too excessive or too low and it makes me assume finding out behavioral finance all these years has completed this to me.1

I’m extra snug coping with uncertainty. It’s important to be keen to say I don’t know frequently when working with the markets and concentrate on what you possibly can management.

You haven’t any alternative.

I discover this helps in different areas of my life too. Course of over outcomes.

I’m turning into extra numb to cash. Wealth administration requires you to work with numerous wealthy individuals. You mainly have two decisions with how this makes you are feeling about cash:

(1) You’re constantly jealous.

(2) You turn into numb to it.

Working with extraordinary wealth has demystified it for me. I do know acquiring nice riches doesn’t assure contentment.

Don’t get me improper, I nonetheless really feel greed, worry, envy and all the different feelings cash produces. I respect wealth and all the pieces it could actually do for you.

However cash doesn’t impress me as a lot because it as soon as did.

Nearly each necessary choice exists in a state of grey. Monetary choices might be tough as a result of there usually isn’t a proper or improper reply. Most monetary decisions contain trade-offs and are circumstantial relying in your objectives, danger profile, private make-up, and so on.

That is true of most necessary life choices.

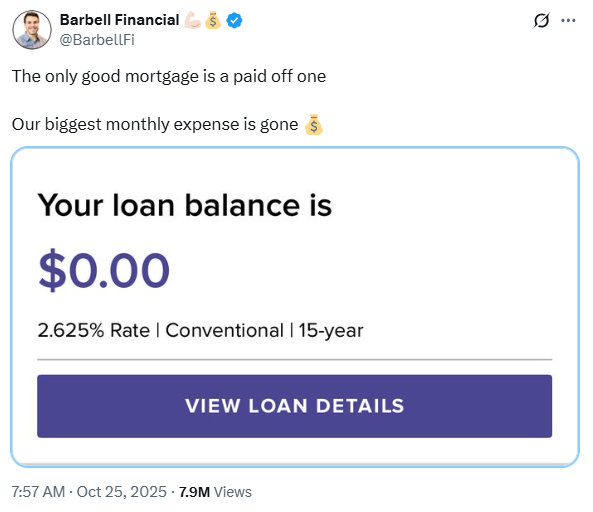

Take this man, as an illustration:

He went viral for posting about how he paid off his 2.265% mortgage.

Some individuals had been offended at this choice. Some individuals fully understood.

Whereas I’m not a black or white man in the case of monetary choices I believe that is nuts. I might by no means do that.

I get individuals eager to repay their mortgage as a result of they detest debt, want freedom from mortgage funds or just need monetary flexibility.

At 5%+ mortgage charges, positive I get that. However I can’t settle for this rationale with a sub-3% mortgage fee. The inflation fee is 3%. Mortgage debt is tax-advantaged. Your home is illiquid.

Simply hold the cash you’ll have used to repay the mortgage in T-bills or a excessive yield financial savings account. For the love of God DO NOT PAY OFF A LOW RATE MORTGAGE!!!

I want I had borrowed even extra cash when rates of interest had been 3%.

Generally individuals take behavioral finance too far. Burying your cash within the yard would possibly assist you to sleep at evening however that doesn’t imply it’s a smart choice.

And guess what?

This man doesn’t care. His mortgage is paid off. Who care what I believe?

That’s one other factor I realized from working in finance — most individuals don’t change their minds or their conduct.

Ah properly.

Michael and I talked about emotions vs. funds, paying off your mortgage and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

How A lot is a 3% Mortgage Price?

Now right here’s what I’ve been studying these days:

Books:

1Or perhaps it’s simply my pure disposition?