“When issues go unsuitable, don’t go together with them.” —Elvis Presley

Should you checked your portfolio Monday afternoon and felt a little bit sick to your abdomen, you weren’t alone. The S&P 500 dropped greater than 2%, and it felt like a type of weeks was shaping up.

However then Tuesday occurred.

The market turned on a dime, ripping larger by over 2%. By Wednesday morning? A 2%+ hole up earlier than the market even opened. All in, this week began with a sequence that’s by no means occurred earlier than in SPY’s historical past: a 2%+ drop on Monday, a 2%+ acquire on Tuesday, and a 2%+ hole larger on Wednesday.

That is real-world volatility.

Market Volatility ≠ Disaster

The kind of market motion we noticed this week isn’t simply uncommon—it’s traditionally important.

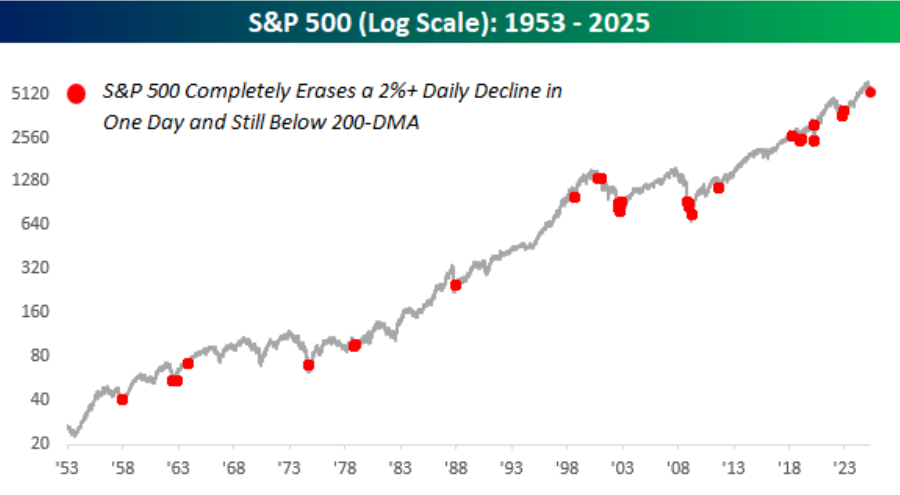

Since 1953, a sequence like this week’s (2%+ drop adopted by a 2%+ acquire whereas beneath the 200-day transferring common) has solely occurred 22 different occasions. The chart from Bespoke Funding Group under exhibits the S&P 500 since 1953 and a purple dot for every incidence.

And people reversals? They’ve usually marked the early phases of robust long-term recoveries. One 12 months later, markets had been up over 20% on common—with a 91% success charge.1

The market can all the time transfer decrease—that’s a risk. However I wish to give attention to possibilities, not potentialities.

The likelihood of long-term beneficial properties in situations like these is closely in favor of traders who maintain regular. That 91% success charge isn’t trivia—it’s a sign.

It’s not in contrast to how a on line casino operates. The home doesn’t must win each hand—it simply wants a constant edge. Staying invested throughout volatility the identical sort of benefit.

In chaotic weeks like this one, it’s our job to separate the sign from the noise.

Nice Leaders Handle By Chaos

Good leaders use information to information their choices. For us, the info is critically essential when deciding whether or not to reinvest after promoting shares vs. holding money.

We could promote a safety, however that doesn’t mechanically imply we purchase one thing else immediately. Typically, the info says: “Not but.” That’s not guesswork—it’s knowledgeable self-discipline.

Consider it like a money stream crunch you see coming months out. You don’t double down on ego and hold spending like nothing’s unsuitable. You pivot early — reduce prices, renegotiate phrases, delay enlargement — so you may climate it and are available out stronger on the opposite aspect.

Holding money throughout a market downturn works the identical approach. It’s not about worry or ego—it’s about managing threat till the atmosphere improves.

That stated, our funding group doesn’t fake the info is a crystal ball. It received’t inform us the precise second to begin amassing money, nor will it give us a blinking inexperienced gentle for the proper time to purchase again in. Precision like that doesn’t exist. However accuracy does. And over a 3-, 5-, or 10-year time horizon, it’s greater than ok.

Following a course of that’s correct is dependable sufficient to get the large calls principally proper, even when the precise timing isn’t good. It retains us on the correct aspect of the long-term math.

Eradicating Emotion from Selections

And simply as essential: eradicating emotion from choices. As a result of emotion drives poor choices – in any high-stakes state of affairs. Eliminating that variable offers you a preventing probability to succeed.

Whereas holding money throughout market volatility could be misconstrued as emotional, it isn’t so long as it’s a part of a strategic, disciplined portfolio administration course of and never market timing or panic-driven liquidation. Liquidating out of worry is emotional.

Holding money, for us, is a positioning transfer that offers us the choice to behave with intention when the atmosphere shifts. Optionality is the asset right here.2

Did You Keep Invested This Week?

Should you stayed invested this week, good on you. That’s exhausting. Should you had been tempted to throw within the towel, keep in mind: market swings are a part of the deal. Use them to your benefit—however don’t allow them to hijack your choices.

That is precisely when disciplined planning earns its hold. The exhausting half is sticking to it—or being trustworthy when it’s time to fine-tune it.

Possibly your threat tolerance has shifted. Possibly you’re rethinking how money suits into the larger image. These are good questions—and value wrestling with.

As a result of what issues isn’t what occurred this week—it’s what occurs subsequent. And the way ready you’re for it.

A plan refined with readability stands the check of volatility.

Maintain trying ahead.