An outdated good friend referred to as me the opposite day and whereas catching up, we bought onto the topic of investing.

With all of the uncertainty on the earth, with synthetic intelligence and huge language fashions always evolving, and with market valuations as excessive as they’re… what’s an investor to do? The place ought to we be placing our cash?

You can also make a case for nearly something at this level. The market is overvalued and so shopping for the S&P 500 when the Shiller PE Ratio is at 40 feels insane. The imply ratio is round 17. However the market has been performing nicely! And has carried out nicely even at such lofty ratio ranges!

Add to that how AI and LLMs are upending the world. I don’t envy the place excessive schoolers are in proper now when deciding what to do with their lives. Regulation and coding don’t appear to be fields the place you’ll have an excellent time as an entry stage worker.

Whereas it feels unsure, one factor that we neglect is that the long run is at all times unsure.

However you will need to take motion despite that uncertainty.

We can’t know what the inventory market will do within the subsequent week. Or month. Or yr. The Fed will make it is choices, the markets will react, and perhaps we are going to enter a recession. Perhaps not. The media has been speaking a few recession for 2 or three years, nevertheless it has but to materialize. Or affect the inventory the market.

However in the long term, we imagine it’s going to go up.

Which is why it is nonetheless sensible to make a contribution to your retirement, even when the PE ratios are insane.

To hammer this house, I need to present you two charts:

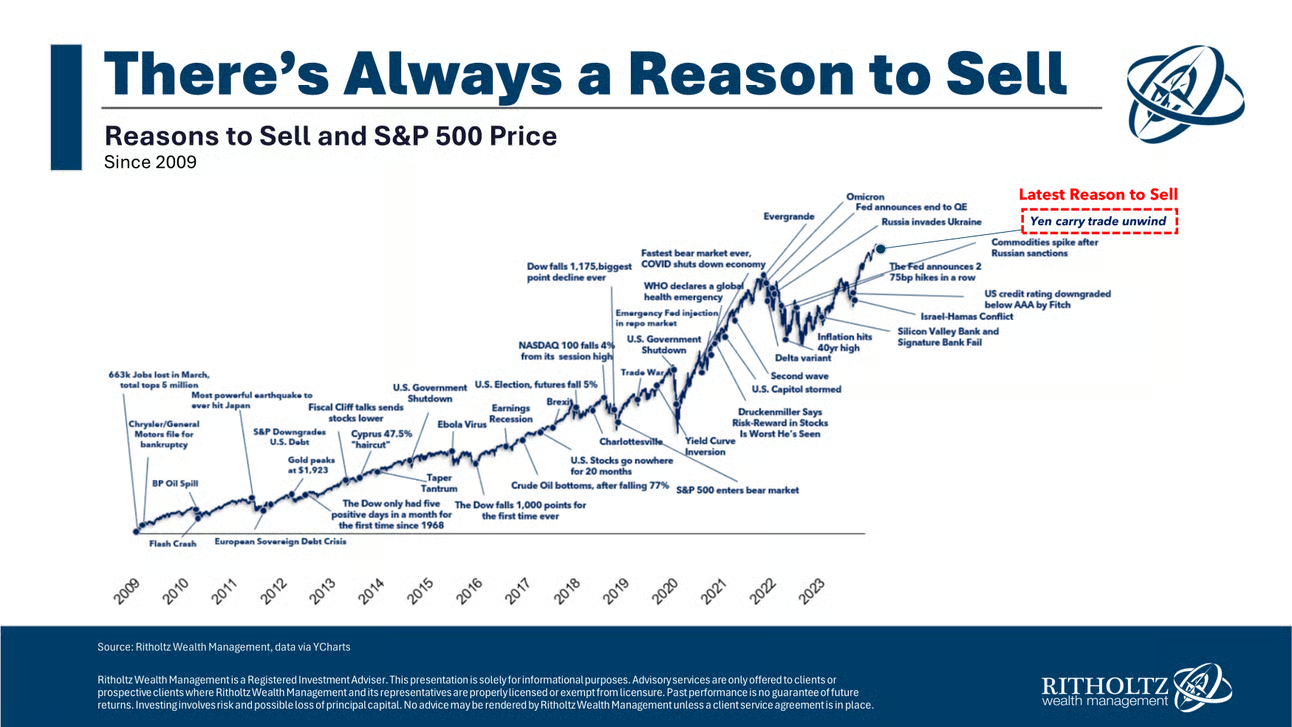

First, there’s at all times a cause to promote. (Or not purchase.)

It comes from Ritholtz Wealth Administration and reveals how traditionally there’s at all times a cause to promote your shares. Unhealthy jobs numbers. Worry of recession. Pandemic. It is a continuous stream of dangerous information. And, truthfully, it is fairly compelling.

There are bumps alongside the way in which. Typically large ones. However discover the S&P 500 chugs alongside up and to the appropriate.

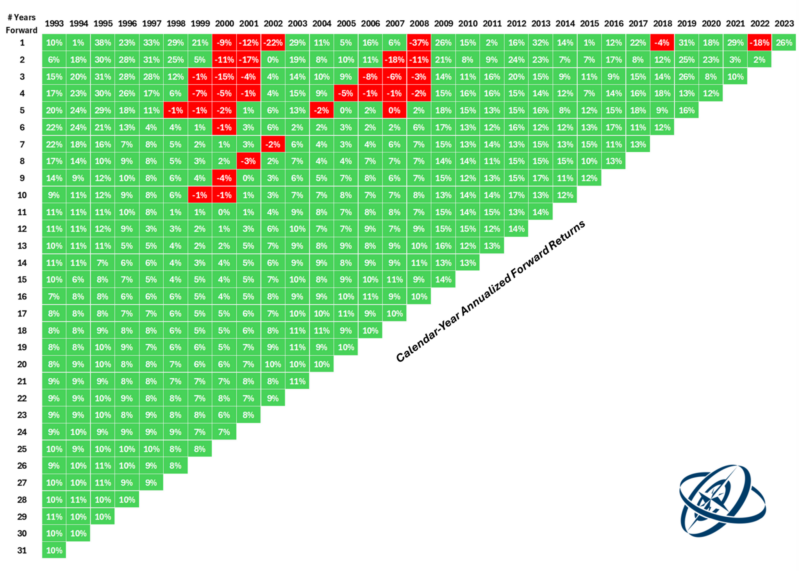

This subsequent chart comes from A Wealth of Widespread Sense and reveals the return of the market over totally different time horizons. It reveals your annual fee of return based mostly on whenever you began investing (the column) and the way lengthy you waited (the row):

In the event you invested in 2000, you had detrimental annualized returns for six years earlier than turning optimistic. In the event you invested in 2008, you had 4 years of detrimental returns earlier than turning optimistic. These are large bumps.

However the desk is overwhelmingly inexperienced. And the purple chunks are throughout durations of large upheaval – the dot com bubble and the Nice Recession. The pandemic hardly registers a blip!

Now might not be one of the best time to spend money on the inventory market. Perhaps it is best to wait till close to yr. Or the yr after. Or go into actual property. Or crypto. However there’s at all times a cause why it isn’t one of the best time.

Or perhaps it is best to make investments right this moment and examine your account steadiness in twenty years.

In the event you wait lengthy sufficient, it’s going to appear like an excellent determination.