Discover Gold Value Historical past in India from 1978 to the current. Be taught key tendencies, dangers, and returns to see if gold is a great funding at this time.

Earlier, I’ve written a number of articles analyzing the historic costs of gold (Refer HERE). Lately, nonetheless, a couple of shoppers requested a contemporary replace reflecting the present tendencies and market dynamics. This impressed me to jot down this detailed, data-driven put up to offer a complete view of gold’s efficiency and outlook.

Gold costs have skilled a outstanding and, at occasions, parabolic surge lately, with home costs in India climbing from a median of roughly Rs.48,651 per 10 grams (24K) in 2020 to round Rs.1,28,890 in 2025 (as of October). This sharp appreciation is pushed by two dominant, data-supported tendencies: elevated world uncertainty and historic central financial institution accumulation.

International Uncertainty and Protected-Haven Demand: Since 2020, the world has confronted unprecedented financial volatility, excessive world inflation, fiscal considerations (particularly within the US), and escalating geopolitical tensions, together with conflicts in Jap Europe and the Center East. Such situations weaken investor confidence in riskier belongings and fiat currencies, prompting a major flight to gold as a dependable retailer of worth. Moreover, a weaker US Greenback and market expectations of US Federal Reserve rate of interest cuts improve gold’s enchantment, as non-yielding belongings like gold profit in a decrease real-interest charge surroundings.

File Central Financial institution Demand: Over the previous three a long time, central banks have utterly modified their method to gold. As per the World Financial Discussion board (WEF) citing World Gold Council (WGC) knowledge, in the course of the Nineties, they have been internet sellers, offloading round 400–500 tonnes a 12 months, primarily by developed nations just like the UK, Switzerland, and the Netherlands. This pattern reversed after the 2008 world monetary disaster, when belief in fiat currencies weakened. Between 2010 and 2020, central banks changed into regular internet consumers, including over 5,500 tonnes of gold to their reserves.

The tempo accelerated after the Russia–Ukraine battle and world inflation surge, with report purchases of 1,136 tonnes in 2022 and 1,037 tonnes in 2023. In accordance with the WGC Gold Demand Traits Q2 2025 report, the shopping for momentum has continued — central banks added round 387 tonnes within the first half of 2024 and are estimated to have collected over 750 tonnes by mid-2025.

This sustained accumulation, led by China, India, Poland, and Turkey, displays a world shift away from U.S. greenback dominance and rising geopolitical uncertainty. Gold has as soon as once more emerged as a strategic financial asset, anchoring world reserves and supporting its long-term value uptrend.

Which one main issue is presently driving gold costs upward?

Most individuals imagine that the current surge in gold costs is especially pushed by retail investor demand or by non permanent “safe-haven” shopping for from institutional buyers. Nonetheless, the precise pattern tells a very completely different story.

Whereas gold costs all the time react within the quick time period to rates of interest, inflation, and U.S. greenback actions, the WGC highlights that the structural, long-term demand is being anchored by report central financial institution shopping for. Since 2022, central banks have bought over 2,100 tonnes of gold — the very best two-year complete in historical past. This constant accumulation, particularly by nations like China, India, Turkey, and Poland, displays a rising insecurity within the world monetary system’s greenback dominance and considerations over potential sanctions or forex volatility.

Briefly, in line with WGC knowledge and evaluation, central financial institution diversification — pushed by geopolitical danger and de-dollarization — is the dominant drive sustaining the gold bull pattern, even when short-term financial situations fluctuate.

Gold Value Historical past in India (1978–Current): Traits & Returns

For this evaluation, I’ve used the month-to-month common gold value knowledge offered by the World Gold Council (earlier, they used to supply every day knowledge). Overlaying the interval from 1978 to 2025, this dataset consists of 572 month-to-month knowledge factors, representing practically 48 years of historic gold costs. I imagine this in depth dataset is greater than ample to guage gold as an asset class over the long run.

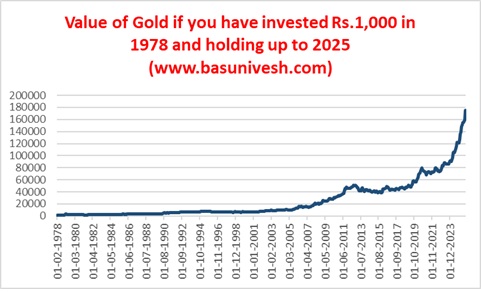

Let’s first have a look at what would have occurred for those who had made a lump sum funding again in 1978 and the way a lot it may have grown by now. Suppose you had invested Rs. 1,000 in 1978. By 2025, that quantity would have grown to a whopping Rs. 1,74,673! Spectacular, isn’t it? However don’t get carried away simply by this point-to-point determine. Judging returns solely on this foundation might be deceptive.

To get a clearer image, we have to think about the CAGR (Compound Annual Development Price), which, on this case, involves round 11.5% per 12 months. Not dangerous in any respect! Nonetheless, the trail to this development wasn’t clean or simple. There have been ups and downs alongside the best way. That’s why, as an alternative of relying solely on point-to-point returns, it’s important to additionally study rolling returns, drawdowns, and rolling danger to really perceive the efficiency of any funding.

Drawdown of Gold from 1978 to 2025

Many people imagine that holding gold is all the time protected and that its worth by no means falls. However that’s solely half the reality. Let’s take a better have a look at the drawdown knowledge from 1978 to 2025.

Drawdown measures how a lot your funding has fallen from its peak earlier than recovering. It primarily reveals the non permanent loss you expertise throughout a market downturn. For instance, think about you invested Rs. 10 lakh in a mutual fund. At one level, it grows to Rs. 12 lakh. Later, a market crash brings it all the way down to Rs. 9 lakh, earlier than it will definitely climbs again to Rs. 12 lakh. Right here, the drawdown is 25%—calculated as:

This implies your funding confronted a short lived 25% drop at the moment.

If you happen to have a look at the historic knowledge for gold between 1978 and 2025, the utmost drawdown was round 45%, the common drawdown was 8.95%, and the median drawdown was 5.4%. (The median is the center worth when all numbers are organized so as; half are smaller and half are bigger. In contrast to the common, it isn’t skewed by extraordinarily excessive or low values.)

These numbers reveal that gold, regardless of its status, has skilled vital volatility through the years.

1 12 months Rolling Returns of Gold from 1978 to 2025

Allow us to now look into 1-year rolling knowledge primarily based on the month-to-month knowledge obtainable from the interval of 1978 to 2025 (1-year rolling knowledge means taking a look at each consecutive 12-month interval within the dataset. For instance, with month-to-month knowledge from 1978 to 2025, you calculate returns for Jan 1978–Dec 1978, Feb 1978–Jan 1979, Mar 1978–Feb 1979, and so forth, transferring one month at a time.)

Knowledge noticed – 560, Common return – 12.12%, Median return – 7.74%, Volatility – 21.23%, Minimal return – -25.16% and Most return – 189.18% and Damaging intervals – 154.

Gold delivered optimistic 1-year returns 73% of the time, however with excessive volatility — the vary between –25% and +189% reveals the speculative nature of short-term actions.

3 Years Rolling Returns of Gold from 1978 to 2025

Knowledge noticed – 536, Common return – 9.7%, Median return – 9.22%, Volatility – 8.85%, Minimal return – -8.71% and Most return – 33.78% and Damaging intervals – 84.

Over any 3-year interval, gold was optimistic 84% of the time. Danger is significantly decrease than in 1-year intervals, exhibiting that holding for not less than 3 years smooths volatility. However have a look at the returns round 50% of the time the returns have been lower than 9.22%.

5 Years Rolling Returns of Gold from 1978 to 2025

Knowledge noticed – 512, Common return – 9.6%, Median return – 10.03%, volatility – 7.18%, minimal return – -6.7% and most return – 27.3% and destructive intervals – 61.

Gold turned optimistic in additional than 88% of all 5-year holding intervals. Lengthy-term buyers noticed much less volatility. Nonetheless, by no means ignore the intervals the place the returns are destructive and in addition 50% of returns are lower than 10.03% (median return worth).

10 Years Rolling Returns of Gold from 1978 to 2025

Knowledge noticed – 451, Common return – 9.5%, Median return – 9.03%, volatility – 4.5%, minimal return – 2% and most return – 20.52% and destructive intervals – 0.

Not a single 10-year interval produced a destructive return. Gold’s long-term return (9.5%) may be very constant, although not spectacular, reinforcing its function as a wealth preserver. However once more, I’m making an attempt to spotlight right here that the 50% of occasions regardless that you might have invested in gold and held it for round 10 years, then 50% of the time, the returns have been lower than 9.03% (regardless that no destructive returns).

This once more clearly reveals that gold is supposed for preserving your wealth like a Financial institution FD however don’t anticipate the exaggerated returns like fairness (even after holding for long run).

Allow us to now perceive the volatility of gold by way of rolling volatility. With month-to-month knowledge, rolling volatility is calculated by taking returns of the final 12 months (for 1-year), 36 months (3-year), and so forth, and measuring how a lot they fluctuate utilizing commonplace deviation. Then you definately transfer ahead one month at a time and repeat. This provides a time sequence exhibiting how “bumpy” the funding has been, with longer intervals smoothing short-term swings and shorter intervals exhibiting fast adjustments.

Rolling volatility tells you ways “bumpy” an funding’s returns are over time. For intervals like 1, 3, 5, or 10 years, it seems on the returns inside that interval, calculates how a lot they fluctuate, after which strikes ahead month by month to offer a steady image of danger. Longer intervals clean out short-term ups and downs, whereas shorter intervals replicate fast market swings. In contrast to rolling returns, which measure how a lot an funding gained or misplaced over every interval, rolling volatility focuses on how unpredictable or dangerous these positive factors and losses have been. In easy phrases, rolling returns present “how briskly the automobile went,” whereas rolling volatility reveals “how bumpy the journey was.

1 Yr Rolling Normal Deviation of Gold from 1978 to 2025

The 1-year rolling commonplace deviation knowledge reveals clear cycles of market volatility. It peaked sharply at 54% in 1979, then dropped to ~15% by 1980, reflecting speedy normalization. One other spike occurred in 1981 (~31%), adopted by a gradual decline by way of 1983. From the mid-Eighties to early Nineties, volatility stayed reasonable (8–15%) with transient surges, notably in 1990. The dot-com growth pushed it to 27% in 1999, then eased post-2000 earlier than rising once more forward of the 2008 disaster (~23%). Volatility remained elevated throughout 2008–2009, then stabilized by 2012. From 2013 to 2020, it stayed range-bound (8–13%), with minor spikes in 2016 and 2018. Submit-COVID, volatility stayed low (7–13%), ending at 11% in late 2025. Total, the information displays how short-term market danger fluctuates with financial cycles, crises, and recoveries.

3 Yrs Rolling Normal Deviation of Gold from 1978 to 2025

The three-year rolling commonplace deviation reveals broader market volatility tendencies with smoother transitions. Volatility peaked at 37% in 1981, then steadily declined to 10% by 1985, marking a shift to stability. From the mid-Eighties to early Nineties, it stayed reasonable (10–16%), with a quick spike in 1990. The mid-Nineties noticed a peaceful section (8–10%), adopted by an increase in the course of the dot-com growth, peaking at 17% by 2000. Submit-2002, volatility eased, however climbed once more in the course of the 2008 disaster (~20%), earlier than stabilizing round 11–13% by way of the 2010s. Lately, it has hovered round 10–12%, ending at 10% in late 2025. Total, the 3-year measure highlights long-term shifts in market danger, filtering out short-term noise.

5 Yrs Rolling Normal Deviation of Gold from 1978 to 2025

The 5-year rolling commonplace deviation graph reveals long-term shifts in market danger. Volatility was highest within the early Eighties, nearing 35%, signaling extended instability. It declined steadily by way of the late ’80s and ’90s, bottoming close to 8%, indicating diminished danger. The dot-com growth and 2008 disaster reignited volatility, pushing it again to ~20%. Submit-crisis, danger steadily eased, stabilizing round 15% by way of the 2010s. From 2015 onward, the pattern reveals a constant decline, settling close to 10% by 2022. Total, the graph highlights how systemic occasions drive multi-year danger cycles, with current years reflecting a comparatively low-risk surroundings.

10 Yrs Rolling Normal Deviation of Gold from 1978 to 2025

The ten-year rolling commonplace deviation graph highlights long-term market danger tendencies with a transparent downward trajectory. Within the late Eighties, volatility was elevated above 20%, signaling persistent systemic uncertainty. Over the subsequent 20 years, danger steadily declined, with solely modest bumps in the course of the dot-com bubble and the 2008 monetary disaster. By the mid-2000s, the usual deviation stabilized round 10–12%, and lately, it has hovered close to 10%, reflecting a structurally lower-risk surroundings. Total, the 10-year measure confirms that long-term market volatility has compressed over time, suggesting improved resilience and diminished systemic shocks.

Regardless of its status as a safe-haven asset, gold has proven significant volatility throughout all timeframes. The 1-year rolling commonplace deviation reveals sharp spikes — as much as 54% in 1979 and 27% in 1999 — underscoring gold’s sensitivity to short-term shocks. The three-year and 5-year measures clean these fluctuations however nonetheless replicate elevated danger throughout systemic occasions just like the dot-com bubble and 2008 disaster, with volatility reaching 20–37%. Even the 10-year rolling commonplace deviation, which captures long-term tendencies, reveals sustained danger: it hovered above 20% within the late Eighties, and although it declined over time, it remained within the 10–20% vary for a lot of the interval. This means that gold, whereas much less risky than equities in some contexts, is way from risk-free — particularly when seen by way of the lens of ordinary deviation. In conclusion, gold’s long-term danger profile isn’t fully clean; it displays structural volatility tied to macroeconomic cycles, making it a strategic however inherently fluctuating asset.

Closing Ideas: Gold Is Dangerous, Cyclical — and Requires Self-discipline

Gold has lengthy been marketed as a safe-haven and diversification software, however the knowledge from 1978 to 2025 tells a extra complicated story. Whereas it delivered a stable CAGR of 11.5% and by no means posted a destructive return over any 10-year interval, the journey was removed from clean. The utmost drawdown of 45%, frequent short-term losses, and excessive 1-year rolling volatility (peaking at 54%) present that gold is very reactive to macroeconomic shocks. Even over longer horizons, 3-year and 5-year rolling commonplace deviations reached 37% and 35%, and the 10-year measure hovered between 10–20% for a lot of the timeline — confirming that gold carries structural danger, not simply short-term noise.

This challenges the frequent perception that gold mechanically reduces portfolio danger. Including gold for “diversification” solely works if it behaves otherwise from different belongings throughout stress — however historical past reveals that gold can fall sharply, keep underwater for years, and transfer in tandem with world danger sentiment. It’s not a volatility buffer; it’s a volatility participant. Furthermore, half of all 10-year rolling returns have been under 9.03%, reinforcing that gold is best at preserving wealth than multiplying it.

So sure, you may add gold to your portfolio — however a ten–15% allocation received’t transfer the needle except you actively rebalance between fairness, gold, and glued earnings. If you happen to’re not comfy doing that (resulting from tax considerations or behavioral inertia), gold might add complexity with out delivering its supposed profit. For individuals who “should” have publicity, equity-oriented multi-asset funds with built-in rebalancing could also be a better route.

Additionally, don’t anticipate gold to all the time hedge inflation. There have been 15-year intervals the place gold returns have been in single digits whereas inflation and glued earnings returns have been in double digits. Gold generally protects, generally disappoints. If you would like a slice of its long-term return, you should be ready for the volatility and self-discipline it calls for — and most buyers aren’t.

In conclusion, gold isn’t a low-risk asset. It’s a strategic software for wealth preservation, not multiplication. Use it with readability, rebalance with intent, and by no means let its shine blind you to its bumps. Gold might diversify returns, nevertheless it doesn’t diversify away danger.