These are the latest most drawdowns for a handful of big expertise shares:

- Oracle -46%

- Meta -25%

- Netflix -30%

- Nvidia -17%

- Broadcom -21%

- AMD -25%

Sans Netflix, these are among the greatest names within the AI commerce. That is what everybody has been worrying about for fairly a while now.

What occurs when the AI commerce unwinds?

These firms are price a mixed ~$9 trillion in market cap. Absolutely the inventory market is falling proper?

No (and don’t name me Shirley).

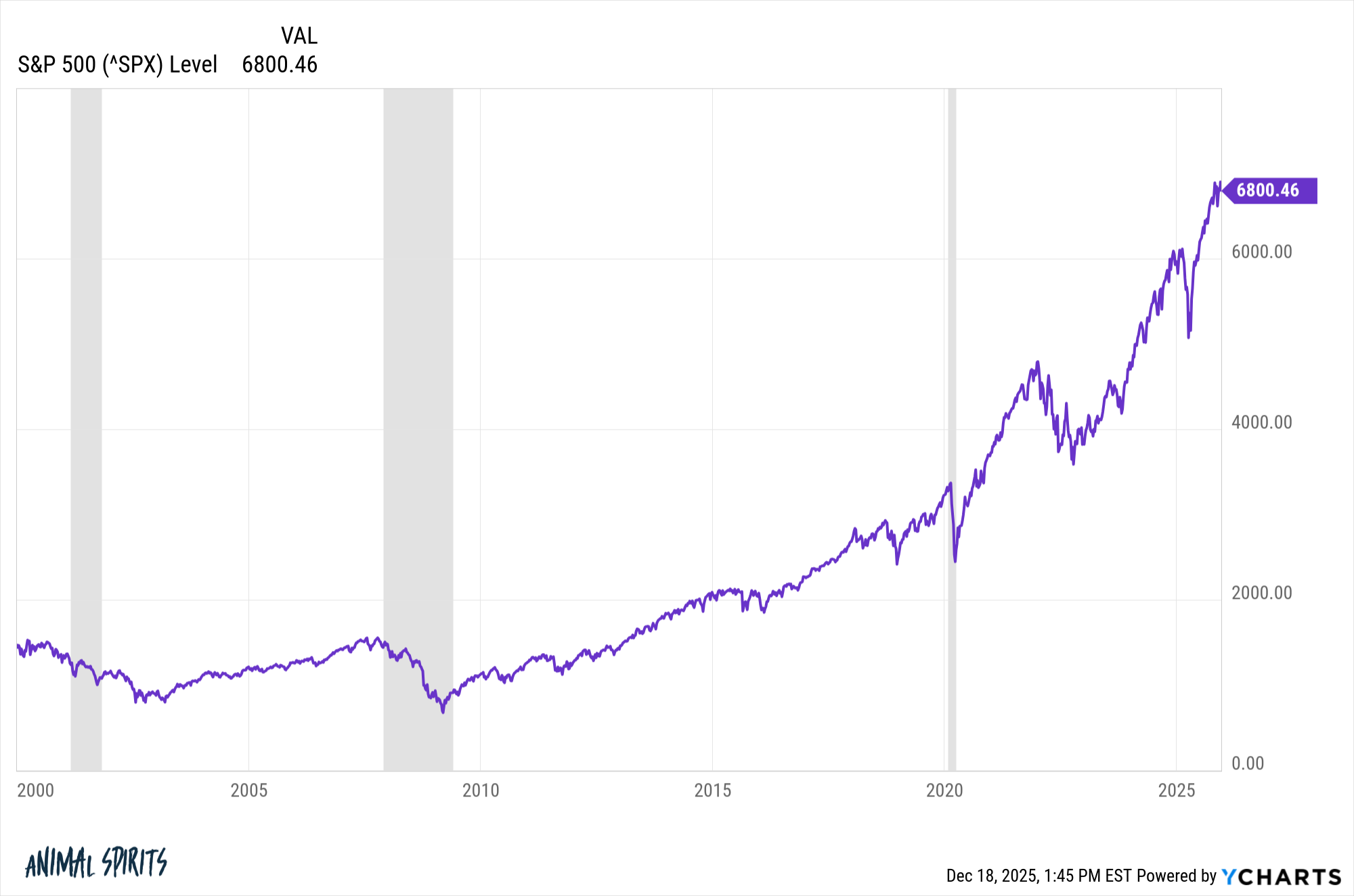

The S&P 500 is inside spitting distance of latest all-time highs:

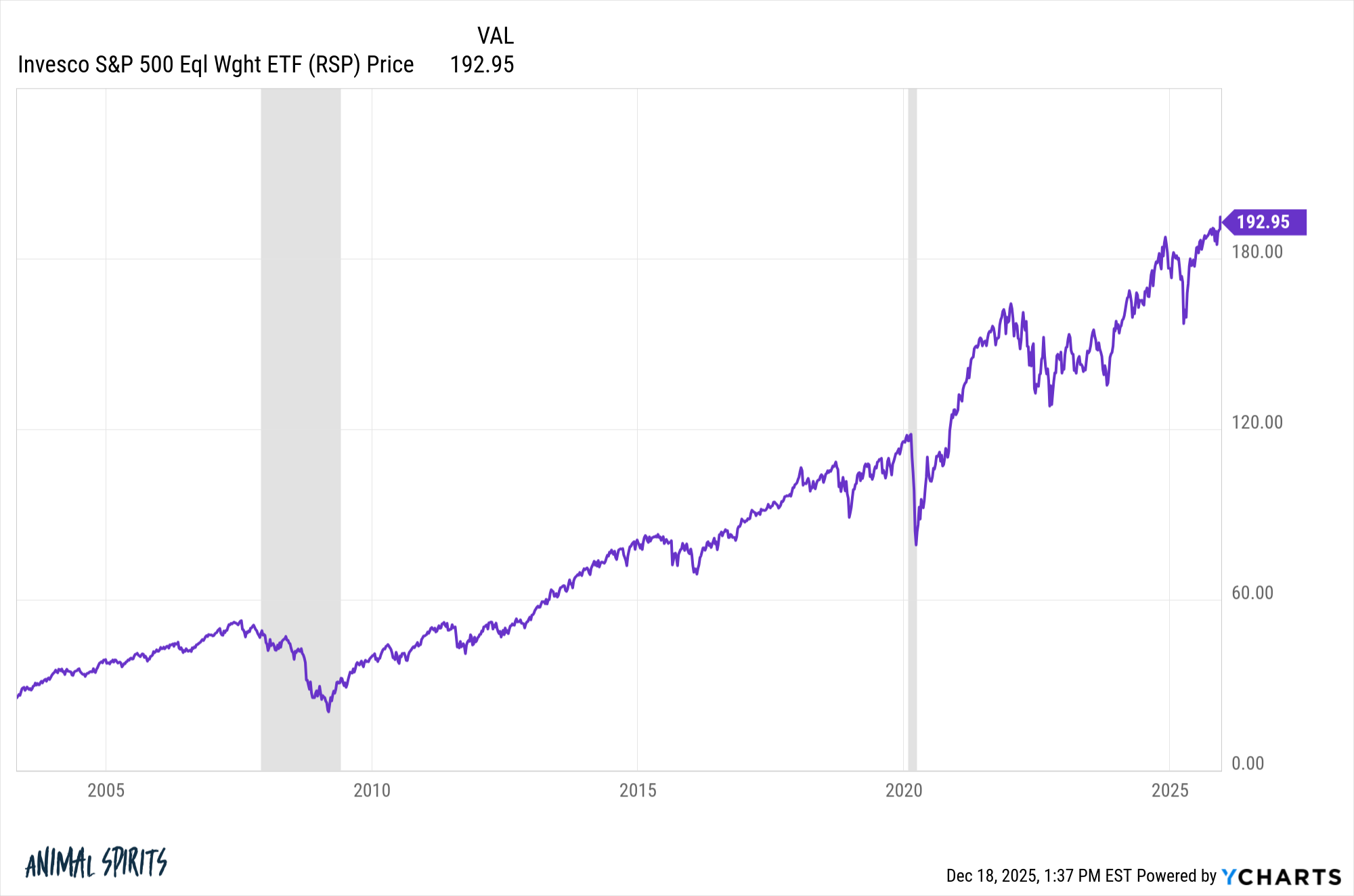

The equal-weighted S&P 500 hit new all-time highs this week:

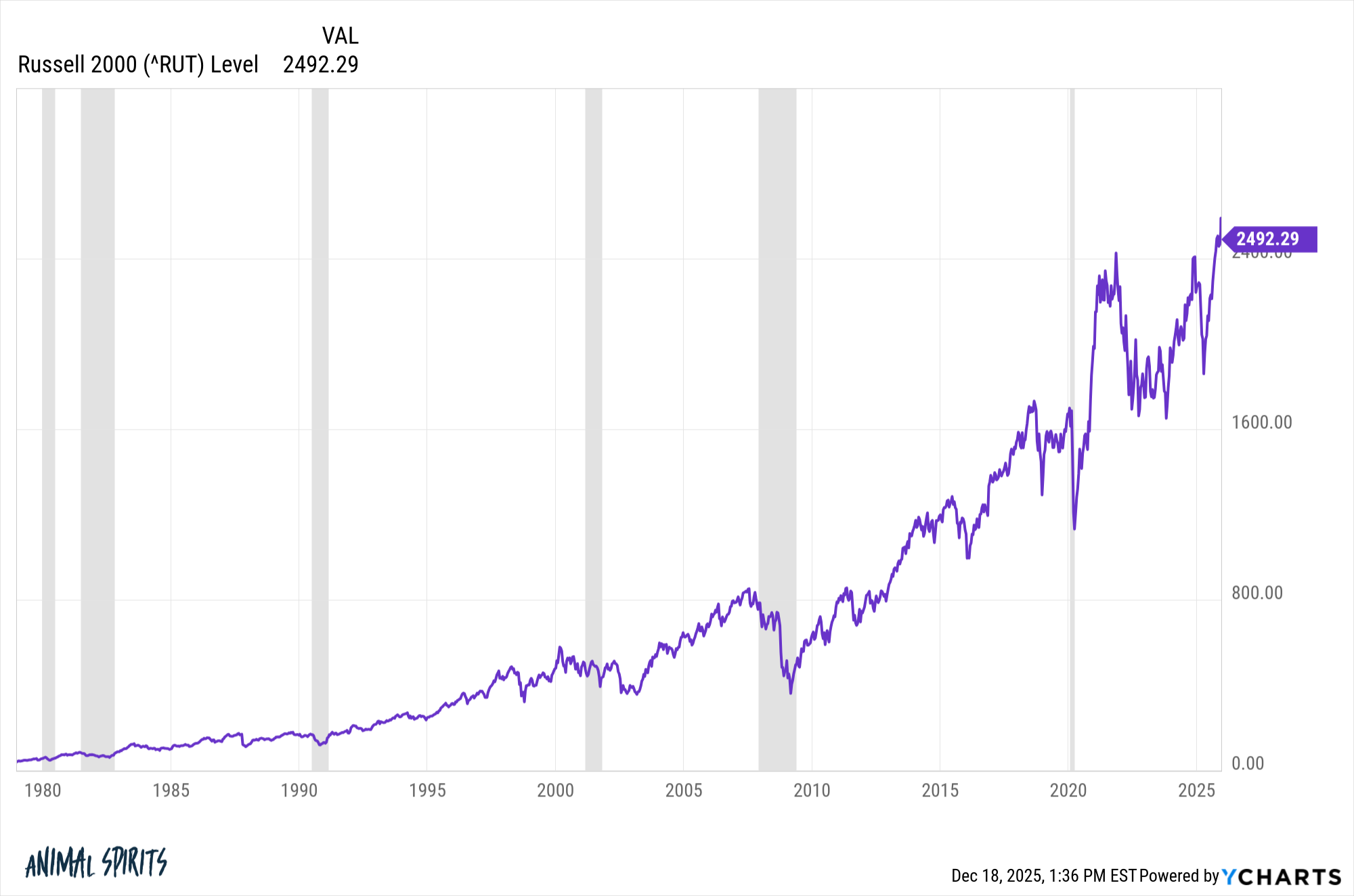

So did the Russell 2000 Index of small cap shares:

Inventory market focus has been a fear for sure market pundits for years now.

Simply wait till the tech shares rollover. The market goes to get crushed!

Perhaps that may occur sometime, however this stuff are fluid. If tech shares do falter it’s additionally doable different elements of the market will fill the void. That’s precisely what’s occurring proper now.

I don’t spend a lot time worrying about inventory market focus as a result of that’s how the inventory market works. The long-term beneficial properties are typically pushed by a small handful of winners.

I’m extra involved about buyers who’ve allowed their portfolios to turn out to be overly concentrated throughout this epic bull market run.

There’s an outdated saying: you focus to get wealthy, however diversify to remain wealthy.

I’ve actually seen that play out with most of the wealth administration purchasers we work with at Ritholtz. There are many individuals who come to us in quest of monetary recommendation who struck it wealthy by means of enterprise possession, actual property investing, firm inventory choices or shopping for and holding a small variety of particular person shares over the lengthy haul.

Prior to now 5 years or so the variety of folks with concentrated inventory market beneficial properties has grown by leaps and bounds.

Right here’s a narrative in The Wall Road Journal about an investor who concentrated his portfolio in tech shares for the previous decade and received:

Brian Hahn had most of his financial savings in tech shares for a decade. As an escalating artificial-intelligence frenzy this yr despatched markets to new heights, he bought all of it.

The 51-year-old math trainer for years had about 80% of his investments in tech, together with exchange-traded funds and particular person semiconductor firms. In October, he put most of that cash into gold, which many see as a haven throughout huge market downturns.

“It was an excessive amount of threat for me to imagine that this was going to maintain shifting increased,” stated Hahn.

Good for him.

He doubtless made a bunch of cash in tech shares and has now downshifted into gold. Will this shift work? Time will inform.

Right here’s my concern for buyers like this who concentrated their cash in a handful of tech names over the previous 5-10 years and destroyed {most professional} cash managers within the course of — it’s not all the time going to be this simple.

Clearly, saying this was simple is hindsight bias, however all you needed to do was purchase a handful of the largest name-brand firms on the earth that create services utilized by billions of us each single day. And also you made large returns within the course of!

Purchase-what-you-know will not be going to work eternally.

Dom Cooke wrote a wonderful profile at Colossus about Henry Ellenbogen, a former T. Rowe Value portfolio supervisor who has studied the largest compounders through the years. This half was attention-grabbing:

“We by no means felt cash was going to be free eternally,” he stated. “However we had made some simplifying assumptions after a decade of free cash.”

Ellenbogen will not be reactive. He trades his portfolio as little as doable. However by the start of 2022, it grew to become clear this wasn’t a brief dislocation. The regime had modified. He went again to his research on compounders. In a traditional decade, about 40 shares compound wealth at 20% a yr. Within the free cash period, 120 shares had achieved it. There have been imposters in his portfolio.

So thrice as many firms compounded at 20% per yr than regular. This could be a once-in-a-lifetime cycle for big compounders.

The truth is, I’d be shocked if we ever noticed a state of affairs like this once more.

The inventory market is concentrated on the prime however there are nonetheless loads of different shares that may soften the blow when the largest names stumble.

However you probably have an ultra-concentrated portfolio of shares there isn’t any cushion if issues go incorrect.

Focus could make you wealthy, and it has made lots of people wealthy on this cycle.

However it might probably additionally take away these beneficial properties or make you poor in a rush.

Diversification goes to matter once more in some unspecified time in the future.

Michael and I talked about inventory market focus, the AI reversal, new all-time highs and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The New Regular of Inventory Market Focus

Now right here’s what I’ve been studying currently:

Books: