A reader asks:

There are many monetary guidelines of thumb on the market. Do you’ve a rule of thumb for when to prioritize paying down a mortgage as a substitute of investing? I’ve a price at 6.375% for $470,000 and I’m 30 years previous. How ought to I be eager about this?

I like questions like this as a result of there are black, white and shades of grey solutions.

Right here’s my normal rule of thumb:

In case your mortgage price is underneath 4% to 4.5% it doesn’t make any sense to pay it off.

Finance is private and a few folks despise debt. However I can’t settle for paying off debt at such a low borrowing price when inflation is 3%. It makes zero sense, emotions be damned.

Something 7% or increased and you must significantly think about making an additional cost right here or there. That’s a decently excessive hurdle price.

Meaning the 4% to 7% vary is not any man’s land. Seller’s selection.

Some folks like making one further mortgage cost a 12 months. Others choose to do an additional principal cost every month.

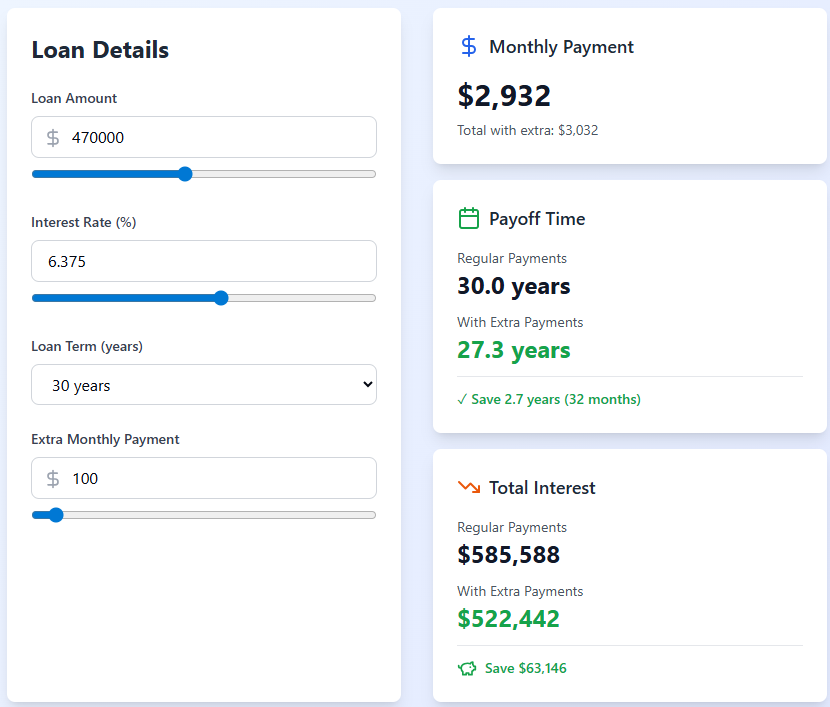

I had my new good friend Claude create a easy mortgage calculator1 so let’s take a look at how further month-to-month funds would influence the numbers. Right here’s what an additional $100/month would appear to be:

You shave a couple of years off the mortgage and present a wholesome financial savings in curiosity expense.

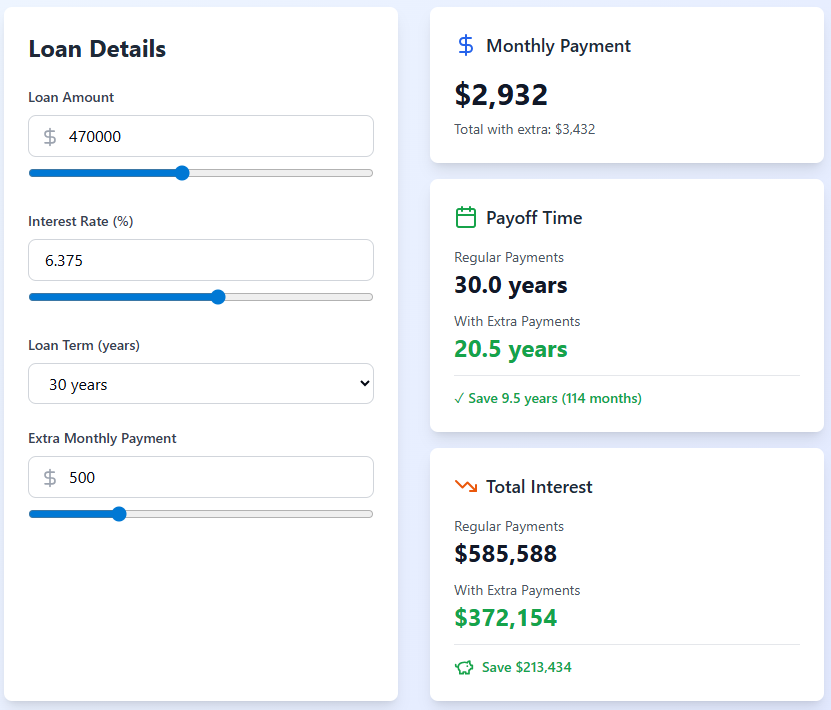

Now right here’s $500/month in further funds:

That’s not unhealthy.

It might take an additional $1,100 or so each month to show a 30 12 months mortgage right into a 15 12 months mortgage.

The issue could be very few householders stay in the identical home for the lifetime of a mortgage and by no means refinance. The hope could be you can refinance your 6.375% right into a decrease price within the years forward.

You additionally have to weigh your choice for debt compensation versus your want for flexibility and liquidity. As soon as that cash is in the home it’s not popping out until you promote it or borrow in opposition to it. If you happen to spend money on the inventory market, you’ll be able to at all times get your a refund by promoting.

After all, the mortgage price is a assured return. Inventory market returns aren’t assured to be as excessive sooner or later as they have been previously.

The most important issue past the rate of interest is your age. You’re solely 30 years previous. You might have a few years of compounding forward of you. You would possibly transfer within the years forward. You’ll most likely refinance right into a decrease price. You would possibly resolve to money out a few of your property fairness to pay for a renovation.

These choices are at all times private.

I’m by no means paying off my 3% mortage early however 6% and alter would possibly change the calculus.

Some folks have very sturdy opinions about choices like this. You at all times repay the debt early it doesn’t matter what! No you by no means repay the debt early!

I don’t like going to extremes. It doesn’t must be all or nothing.

I like diversification in all issues. Diversification of revenue streams. Diversification of timing contributions into the market. Diversification by asset class, geography, technique and safety.

If you happen to do resolve to make further mortgage funds, don’t utterly shut off your investments within the inventory market.

They are saying nobody ever regrets paying off their mortgage early.

Nobody regrets placing cash into the inventory market and letting it compound for a number of many years both.

I talked about this query on the most recent episode of Ask the Compound:

I additionally answered questions on when to show off your greenback price averaging into shares, how UCITs work, dwelling fairness as a false type of wealth, proudly owning your property for a brief time frame and spend money on your 401k.

Additional Studying:

The Economics of a 50 12 months Mortgage

1Why didn’t I simply use mortgage calculators that have been already out there? The Claude AI model seems nicer. And it’s less complicated.

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here can be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.