There are such a lot of issues I sit up for throughout Pumpkin Spice Season, however occupied with paying Uncle Sam isn’t certainly one of them! Nevertheless, as a wealth planner, I do know that going through the music in October, with a couple of months left to optimize my tax scenario, goes a good distance in managing my tax legal responsibility. It additionally helps me make knowledgeable selections about actions to take which are consistent with my broader monetary objectives.

Too typically, we give attention to minimizing taxable earnings in any respect prices in a single tax 12 months, whether or not it advances our long-term priorities or not. However with slightly planning, it doesn’t should be this fashion. Take a look at these easy suggestions for strikes to make earlier than year-end to ease the ache come April fifteenth and past, whereas preserving your large image objectives in thoughts.

1. Keep away from Surprises with Your Funding Portfolio – Examine Out Realized Beneficial properties & Earnings to Date

Realizing what you’re incomes at work is fairly clear. Realizing what’s occurring within your funding portfolio is a special story for a lot of busy professionals. Ideally, you need to preserve tabs on this all year long to see if estimated taxes have to be paid, however I’m a realist.

In case you are simply coming to phrases with tax planning for the 12 months, ask your advisor for a report exhibiting realized good points/losses for non-tax-deferred accounts in addition to a report exhibiting earnings out of your investments which may be taxable (like curiosity and dividends). Don’t have an advisor? You could possibly generate stories your self exhibiting this data or test your most up-to-date assertion for year-to-date exercise. Right here are some things to concentrate to:

Curiosity-Bearing Financial savings & Cash Market Accounts

Although rates of interest are coming down, most financial savings and cash market accounts are nonetheless paying larger charges of curiosity than previously. Don’t overlook to test these out, as most often, the curiosity will likely be taxed at your peculiar earnings tax price (not the advantageous price for certified dividends or long-term capital good points).

Actively Managed Accounts and Mutual Funds

Simply since you didn’t promote any investments all year long or request a sale in your account, doesn’t imply that you simply gained’t have realized capital good points. If in case you have an account managed by an advisor or personal mutual funds, you might have realized good points due to this energetic administration or redemption requests from different traders in mutual funds.

Mutual funds typically pay out any capital good points towards the top of the 12 months. Should you personal mutual funds, you need to have the ability to get a projection of capital good points that will likely be handed by way of to you as an proprietor of the fund (separate from any acquire or loss you’ve got on the precise shares of the fund attributable to promoting them).

The excellent news is, there are choices for tax effectivity within your portfolio by way of methods like direct indexing if you’re involved about realized good points including to your taxable earnings.

Funding Earnings from Dividends and Curiosity

Funding earnings generated by simply proudly owning an funding in a non-tax-deferred account is commonly missed, particularly if dividends or curiosity are reinvested. Reinvesting doesn’t imply that you simply gained’t owe taxes the 12 months that the earnings was generated so don’t overlook to have a look!

In reviewing the taxable earnings out of your portfolio, it is possible for you to to get a way in the event you’ll be topic to the Web Funding Earnings Tax. It is a 3.8% tax utilized to web funding earnings for single filers with greater than $200,000 in modified adjusted gross earnings ($250,000 for married {couples} submitting collectively). The tax is simply utilized to the lesser of your web funding earnings or the portion of your modified gross earnings that exceeds the thresholds famous above. That is typically an disagreeable shock in April – there could also be time to take motion earlier than the top of the 12 months to reduce web funding earnings (learn on to quantity 2).

2. Evaluate What’s Lurking Underneath the Floor in Your Funding Portfolio

Did you uncover extra realized earnings out of your portfolio than you anticipated? The excellent news is you’ve got a couple of months left to attempt to cut back that. Request an unrealized acquire/loss report out of your advisor or take a look at your unrealized good points/losses on-line in your non-retirement accounts. Even if you’re snug with the place your realized good points are, there could also be alternatives to higher your tax scenario over the long-term.

Search for positions which are exhibiting an unrealized loss. By leveraging the follow of tax-loss harvesting, traders can promote any securities which have declined at a loss, offsetting the tax burden of good points from different investments. Subsequently, the proceeds of a sale might be reallocated to the same safety, permitting people to decrease their tax invoice whereas on the similar time sustaining their desired asset allocation.

The inevitable caveat

There are some restrictions to this technique. For instance, losses have to be utilized in sequence—long-term losses should first be utilized to long-term good points, whereas short-term losses should first be utilized to short-term good points. Moreover, the IRS stipulates that these trades mustn’t violate the “wash sale” rule, that means that losses can’t be claimed if the safety repurchased is “considerably similar” to the safety bought (and purchased inside a 61-day window).

Tax-loss guidelines are comparatively complicated and would require cautious consideration of claims and their {qualifications}. When deployed strategically, nonetheless, tax losses might be fairly helpful over the long-term as they are often indefinitely carried ahead and utilized till they’re exhausted.

Generally you could wish to harvest good points

If in case you have much less earnings than is typical, have web realized losses, or end up in a decrease tax bracket than anticipated, it could make sense to reap long-term capital good points earlier than year-end to reduce taxes paid on these good points. Appears counterintuitive, however I’ll clarify.

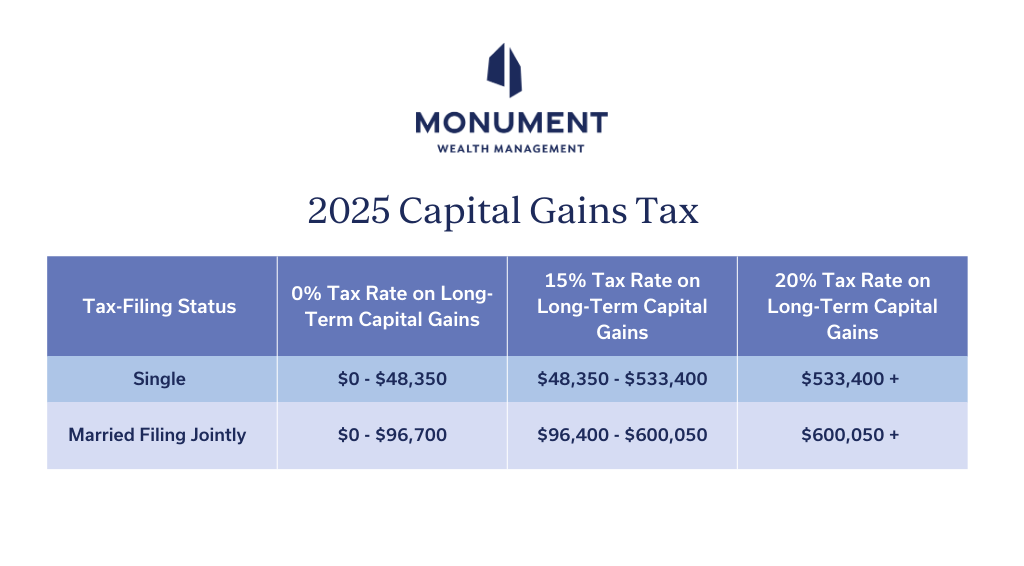

In contrast to your W2 earnings and different kinds of funding earnings, long-term capital good points are taxed at decrease charges pushed by your taxable earnings.

Right here’s how capital good points are taxed in 2025:

It is a nice instance of how tax-planning requires forward-thinking of the large image. By promoting a winner, you may re-set your value foundation within the place and probably pay much less in taxes than you’d sooner or later on the acquire beneath the fitting circumstances.

3. Get a Deal with on Contributions Made to Tax-Deferred Accounts

If you wish to decrease your taxable earnings earlier than the top of the 12 months, taking over the total spectrum of tax deductions can really feel like an awesome job. A simple place to start out is with tax-deferred accounts to be sure you’re maximizing these alternatives.

Office Retirement Accounts

Pre-tax contributions to office retirement accounts are one of many largest methods to cut back taxable earnings whereas saving for long-term objectives. Log in to your retirement plan portal to see how a lot you’ve contributed up to now and the way a lot you’re set to contribute by way of year-end. There’s nonetheless time to regulate, possible with out main impression to your money flows as a high-income earner, and these will possible go additional than IRA contributions, whose deductibility is proscribed for high-income earners. In contrast to IRA contributions, office retirement plan contributions have to be made by December thirty first. The boundaries for 2025 are:

Well being Financial savings Accounts

With a well being financial savings account (HSA), you may decrease your present taxable earnings and create a supply of tax-free wealth out there to cowl present or future medical bills. Not everybody can contribute to those accounts, however if you’re a part of a Excessive-Deductible Well being Plan (see the HSA contribution limits under), be sure you are maximizing this chance! Fortunately, you’ve got till your tax submitting deadline to make this contribution, not December thirty first.

529 Accounts

In case you are saving for a liked one’s future academic prices and reside in a state with earnings tax, you could profit from making contributions to that state’s 529 plan. Deductibility of contributions varies from state to state, in addition to contribution deadlines for receiving the tax deduction (although most are December thirty first). Reducing your state earnings tax burden might be particularly useful given the restricted deductibility of state and native taxes on federal earnings tax returns. There are even tax-efficient, long-term wealth advantages related to 529s past training—due to the Safe Act 2.0; learn right here about new alternatives to roll unused 529 funds to a Roth IRA for a similar beneficiary.

4. Take a look at Different Deductible Buckets

You don’t should be a tax skilled to have an thought of whether or not an expense you paid might decrease your taxable earnings, or if it is smart to take sure actions only for the sake of lowering your taxable earnings earlier than year-end. Glancing on the federal Schedule A may also help jog your reminiscence on what you’ve carried out all year long, from charitable contributions to medical bills, and offer you a place to begin for figuring out if you have already got sufficient deductions to recover from the usual deduction ($15,000 for single filers and $30,000 for married {couples} submitting collectively in 2025).

In case you are near exceeding the usual deduction restrict AND have charitable intentions, or different elective deductible bills you could incur earlier than year-end, you may act earlier than December thirty first to get above the usual deduction and additional cut back your taxable earnings.

There are tax-savvy methods to offer to charitable organizations past simply writing a test:

- Donating appreciated shares of inventory might take away the potential for future capital good points tax on appreciated belongings.

- Organising a Donor Suggested Fund (DAF) might can help you lock in a big charitable deduction once you want it (corresponding to a 12 months the place you’ve got exceptionally excessive earnings attributable to vesting stock-based compensation or a big capital acquire) whereas permitting you to grant cash to your favourite charitable organizations over time.

That is in fact no alternative for talking along with your workforce of advisors, like your wealth advisor and tax skilled! Nevertheless, it’s all the time useful to start out a dialog with them from a spot of understanding your large image.

5. Examine Out Present Tax Credit Obtainable—No matter Earnings Stage

Many high-income earners are unable to make the most of tax credit out there for having youngsters, paying for childcare bills, or pursuing larger training for themselves or dependents. For these contemplating energy-efficiency upgrades to their properties, that is the final 12 months that tax credit out there beneath the Inflation Discount Act could also be taken so now’s the time to behave.

The Vitality Environment friendly House Enchancment Credit score provides a credit score of as much as 30% of prices for enhancements, capped at $3,200 although the cap could also be decrease relying on the sort of enchancment. Issues like home windows, exterior doorways, home equipment, and insulation could also be certified if positioned in service by December 31, 2025. The Residential Clear Vitality Credit score might permit owners to obtain a tax credit score equal to 30% of the fee to put in qualifying renewable vitality tools, corresponding to photo voltaic, wind, or geothermal, in addition to battery storage know-how. Once more, the venture have to be accomplished by December 31, 2025, to be eligible, so there’s much less runway with this tax credit score. The IRS and your CPA might be the authority on this matter if you’re occupied with dwelling upgrades however make certain all the pieces might be accomplished by December thirty first if the tax credit score is a major think about your decision-making!

Work with an Advisor Who Understands Your Huge Image

Because the 12 months winds down, it’s essential to grasp the large image in terms of your taxable earnings. When seen from a broader perspective, you could possibly establish alternatives to decrease your tax burden. Excessive-income earners should additionally stay cognizant of timing in terms of these alternatives, guaranteeing you’re ready to take applicable actions earlier than the 12 months ends.

This will all appear to be a frightening problem to tackle, and in the event you’re hoping to create a long-term tax optimization technique, it gained’t be straightforward to go it alone, particularly as your belongings and monetary image develop in dimension and complexity. In the case of metabolizing complexity for high-earning people like enterprise house owners and executives, the Staff at Monument is nicely suited to assist. We act as your “second mind” that will help you spot alternatives for tax effectivity—or for reaching your different wealth objectives. We analysis you simply as deeply as we analysis the markets and ship clear, concise suggestions that allow you to make high-impact selections with confidence.

Study our Complimentary Wealth Examine.