The Wall Avenue Journal says the center class is getting pessimistic concerning the financial system:

The center class–usually thought of to incorporate households making roughly $53,000 to $161,000 a yr–is enjoying an outsize function in that waning optimism. After months of monitoring high-income earners’ rising confidence concerning the financial system, households making between $50,000 and $100,000 made an abrupt about-face in June. They now extra carefully resemble low-income earners’ gloomier views, in response to surveys executed by Morning Seek the advice of, a data-intelligence agency.

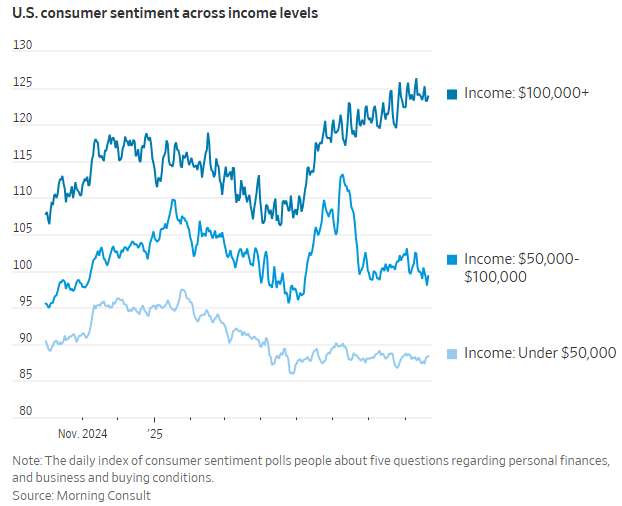

Right here’s a chart that breaks down sentiment by revenue ranges:

You may quibble with their definition of center class however the factor that stands out to me is how unstable these numbers are. Sentiment crashes then shoots larger then crashes once more.

I’m unsure we are able to belief these surveys anymore.

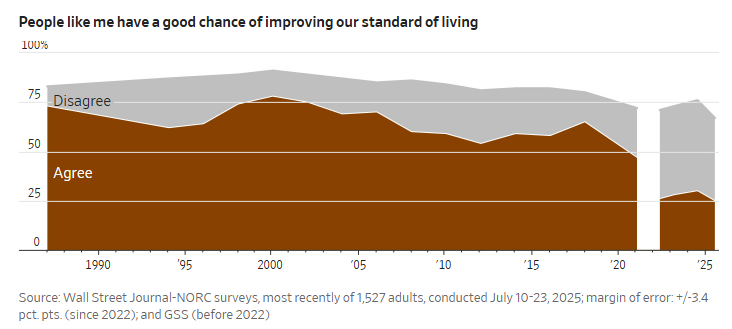

Right here’s one other one from the WSJ that asks folks if they’ve probability of enhancing their way of life:

The article says individuals are dropping religion in the concept that they’ll get forward via onerous work.

Perhaps issues are more durable at this time than they had been up to now. In some methods, they most likely are. In different methods, issues are far simpler.

However take a look at the pattern on this survey over time. It was already going downhill…after which Covid hit and it crashed. I contend some mixture of social media and our collective expertise throughout the pandemic has damaged the vibes for good. We are able to’t belief these sentiment indicators anymore. They’re far too noisy.

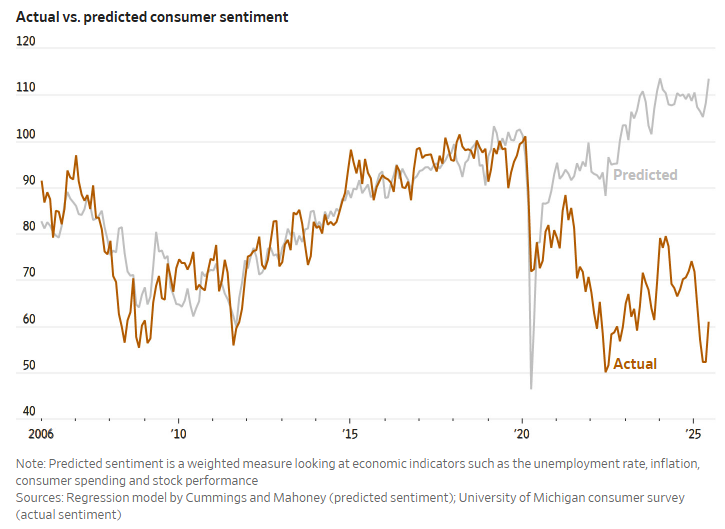

Two Stanford researchers have a mannequin that appears at how the financial system is performing versus the notion of the financial system via sentiment readings. The 2 used to trace carefully. Not anymore:

That is from the story:

“The hole is staggering,” Mahoney mentioned of the separation of sentiment from the stable financial metrics. One issue fueling the hole not too long ago, he mentioned, has been the inventory market growth–“which has traditionally translated into stronger sentiment. However not on this event.”

You need to watch what folks don’t what they are saying. Individuals say a variety of stuff on the web that doesn’t match actuality.

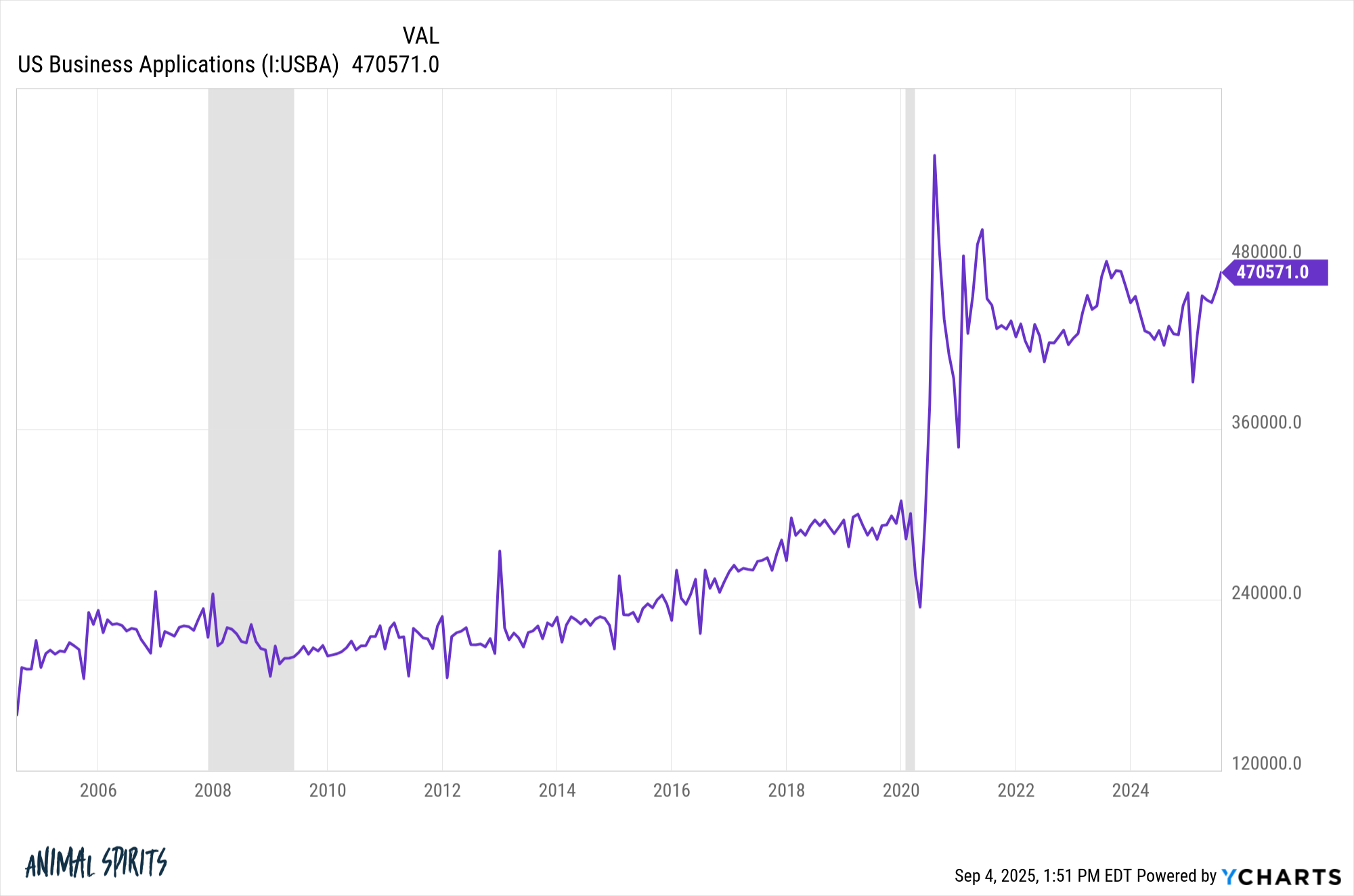

Roger Lowenstein wrote an op-ed within the Journal about American exceptionalism. He says final yr one out of each 24 family registered a brand new enterprise utility. You don’t begin a brand new buisness when you’re fearful concerning the future or onerous work.

Take a look at this chart:

New enterprise functions have exploded for the reason that pandemic whereas sentiment has dropped to the ground.

Which one ought to we belief extra — folks’s emotions or their actions?

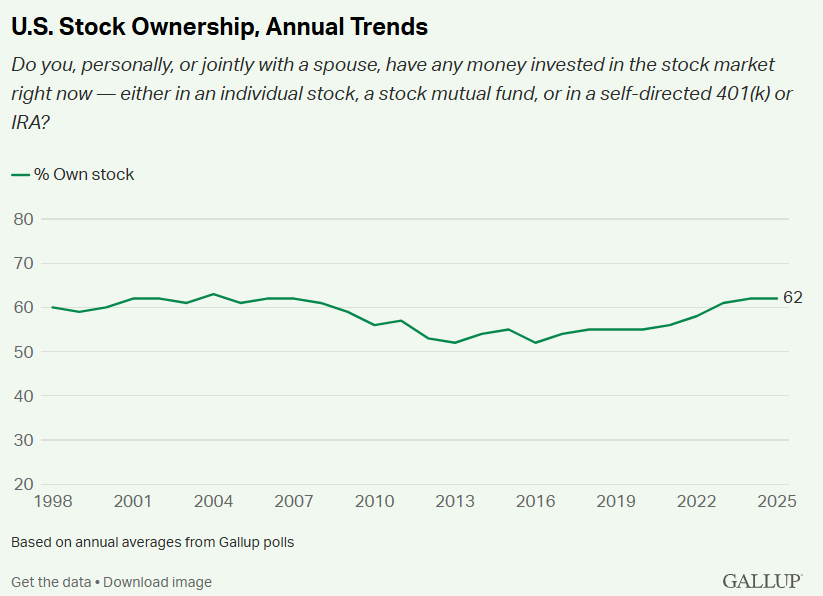

Gallup reveals the variety of households who personal shares continues to rise:

The rise within the 2020s has been substantial, going from 55% in 2019 to 62% now. Would extra folks be investing within the inventory market in the event that they thought issues had been going downhill from right here?

Individuals say they’re pessimistic concerning the future. Their actions don’t match their phrases.

Don’t belief the vibes. They’re damaged.

Perhaps for good.

Michael and I talked about seniment readings, American exceptionalism and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional studying:

The Information is Making You Depressing

Now right here’s what I’ve been studying recently:

Books:

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here will likely be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.