Alan Greenspan’s notorious irrational exuberance speech is a basic instance of how loopy markets can all the time get crazier.

This was the precise textual content from his speech at a coverage dinner in December of 1996:

Clearly, sustained low inflation implies much less uncertainty in regards to the future, and decrease threat premiums suggest greater costs of shares and different incomes belongings. We are able to see that within the inverse relationship exhibited by value/earnings ratios and the speed of inflation prior to now. However how do we all know when irrational exuberance has unduly escalated asset values, which then turn out to be topic to surprising and extended contractions as they’ve in Japan over the previous decade? And the way can we issue that evaluation into financial coverage? We as central bankers needn’t be involved if a collapsing monetary asset bubble doesn’t threaten to impair the true financial system, its manufacturing, jobs, and value stability. Certainly, the sharp inventory market break of 1987 had few damaging penalties for the financial system. However we must always not underestimate or turn out to be complacent in regards to the complexity of the interactions of asset markets and the financial system. Thus, evaluating shifts in steadiness sheets usually, and in asset costs significantly, have to be an integral a part of the event of financial coverage.

The previous Fed chair wasn’t pounding the desk that the inventory market was a bubble however he was definitely implying one thing was afoot.

From 1980 by Greenspan’s speech on the tail finish of 1996, the S&P 500 was up greater than 1,200% in complete or a blistering 16.5% return on an annual foundation. Valuations have been up, up and away. The Netscape IPO occurred a yr earlier. Issues felt very toppy.

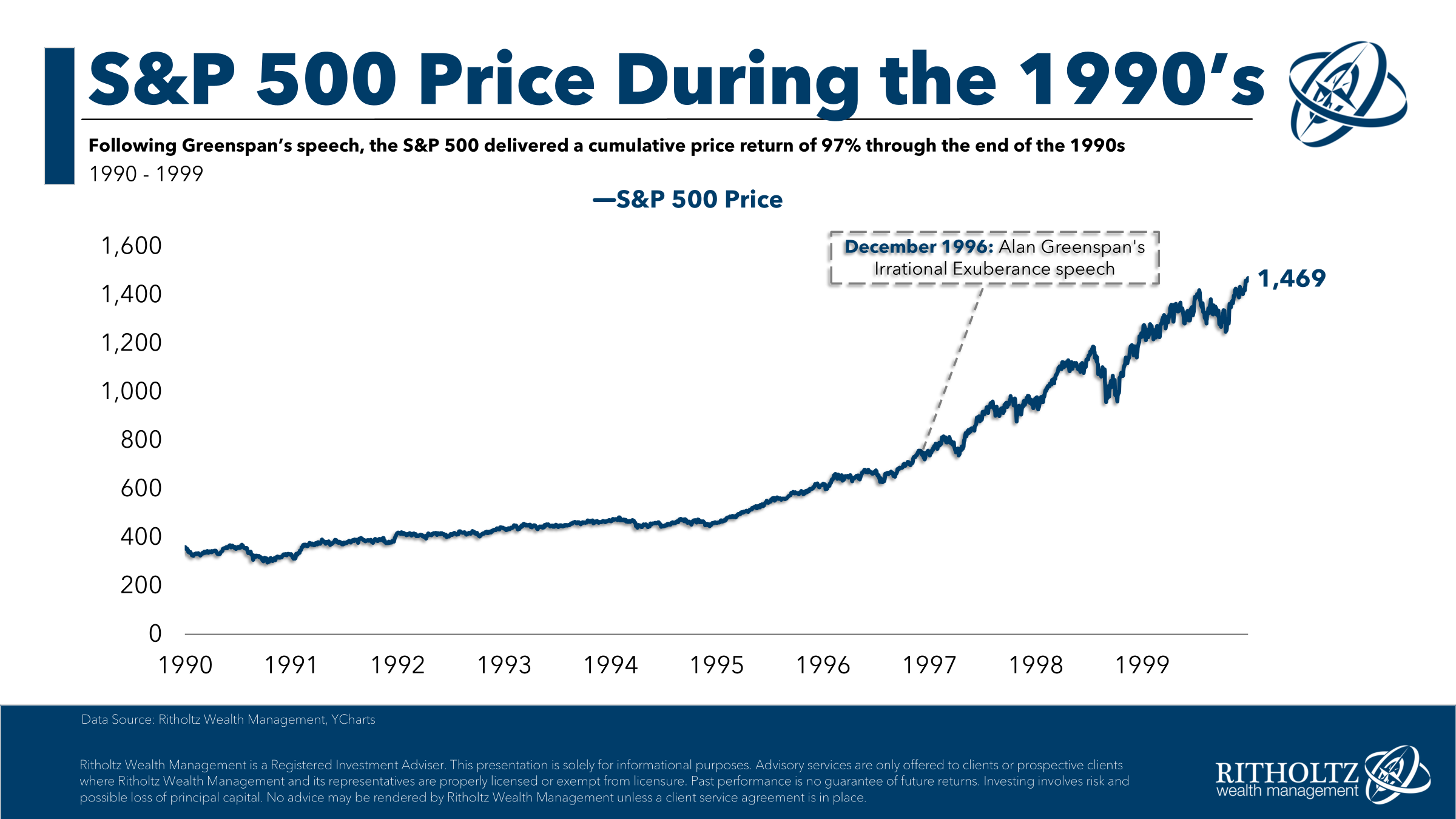

That didn’t matter. The market took off like a rocket ship following Greenspan’s speech:

From the time of Greenspan’s speech by the remainder of the last decade the S&P would greater than double, adequate for an annualized return of almost 26% by the top of 1999. The market was up 33% in 1997, 28% in 1998 and one other 21% in 1999.1

The dot-com bubble lastly burst within the spring of 2000, chopping the S&P 500 in half together with a drawdown of greater than 80% within the Nasdaq.

Some individuals are beginning to surprise if we’re in the same scenario now.

No two markets are ever the identical. The businesses within the dot-com bubble didn’t make any cash. They didn’t have the ridiculous revenue margins tech shares have in the present day. However there are some similarities.

The AI capex spending binge is eerily just like the telecomm buildout that occurred within the Nineteen Nineties.

Speculative exercise is in every single place too — SPACs, meme shares, IPOs, leverage, story shares, excessive valuations, deregulation, and many others.

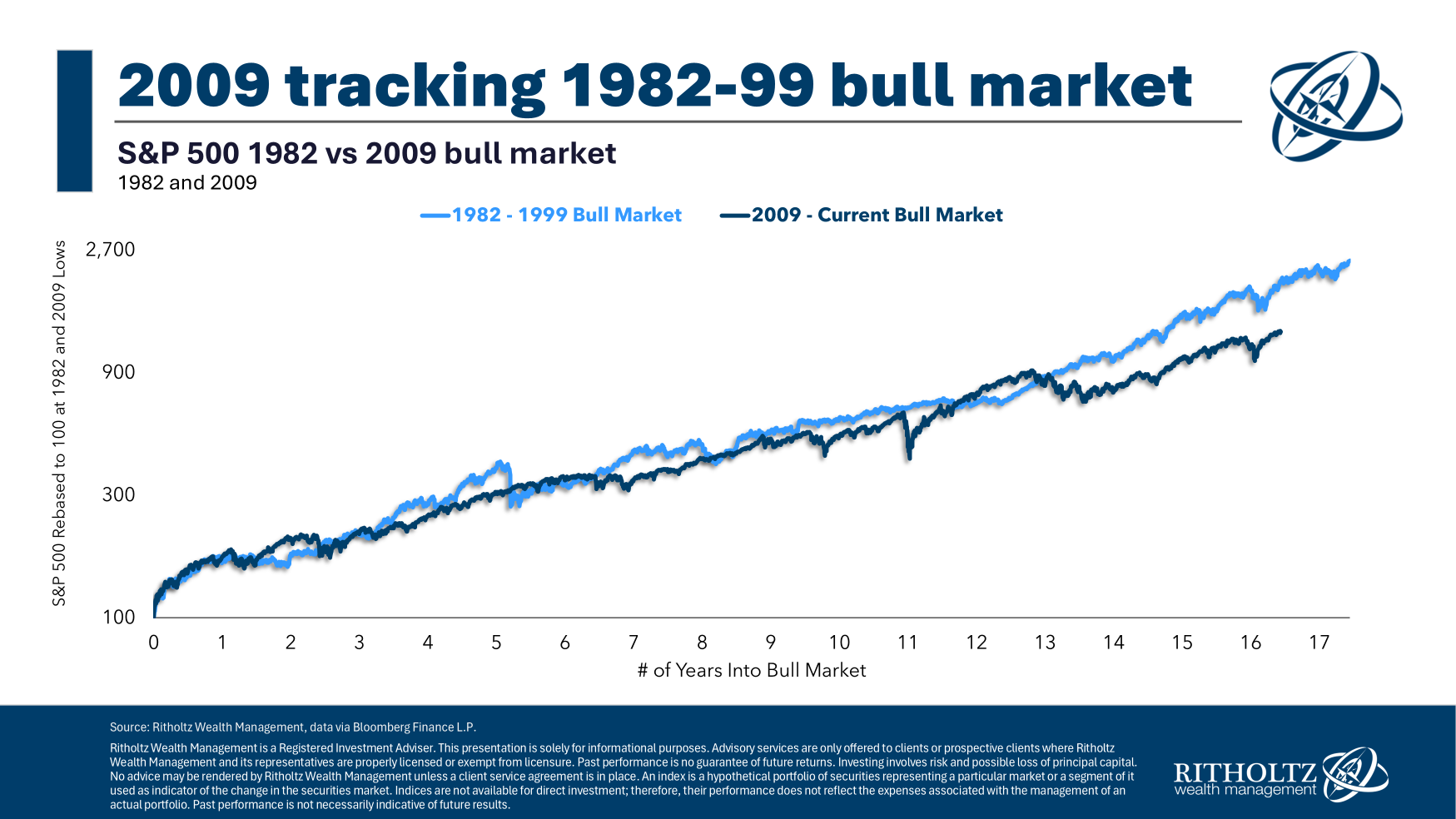

And the 2 bull markets have taken on the same trajectory over time:

Many individuals are attempting to determine whether or not that is the early phases of a bubble or the top of the street.

Investing can be loads simpler if there have been a easy solution to predict all these markets. Sadly, there’s not. Nobody can predict when human nature will take issues too far or when it can cease on a dime. The pendulum all the time swings; we simply don’t understand how far in both path.

Forecasting the market within the brief run is not possible.

Investing for the long term is the very best treatment for the uncertainties of the brief run.

Should you had invested within the S&P 500 following Greenspan’s speech in December of 1996 and held on till in the present day, you’ll be up simply shy of 10% per yr. You’d have needed to stay by two 50% crashes within the subsequent dozen years or so, 9/11, a number of wars, oil going to $150/barrel then damaging, the pandemic, 40-year excessive inflation, the 2022 bear market and a few dozen different run-of-the-mill corrections.

However even in any case that unhealthy stuff you continue to would have roughly gotten the market’s long-term annual return.

That’s not unhealthy.

Should you had invested on the peak of the market simply earlier than the dot-com bubble burst on the finish of 1999, you’ll be up a little bit greater than 8% per yr. That’s not a horrible final result contemplating the entire unhealthy stuff you’ll have needed to stay by plus that was the costliest valuations the U.S. inventory market has ever seen.

Clearly, nobody truly invests like that (besides Bob). Folks don’t put all of their cash to work .

Most individuals spend money on 1996, 1999, 2007, 2009, 2020 and every thing in-between. Among the best options of greenback price averaging into the market over time is that it permits you diversify throughout time, valuation degree and market setting.

Should you’re averaging into the market over time you must welcome volatility.

Should you’re totally invested, you have to be prepared to simply accept volatility or diversify your belongings to dampen no matter ache it could trigger.

This stuff are far simpler and extra useful than making an attempt to foretell the start or finish of a monetary asset bubble.

Additional Studying:

An Epic Bull Market

1And that was following +37% in 1995 and +23% in 1996. Simply an insane run.